Question: A firm considers which strategy is optimal for its globalization initiatives It considers: 1) a Foreign Direct Investment (FDI), which has a present value of

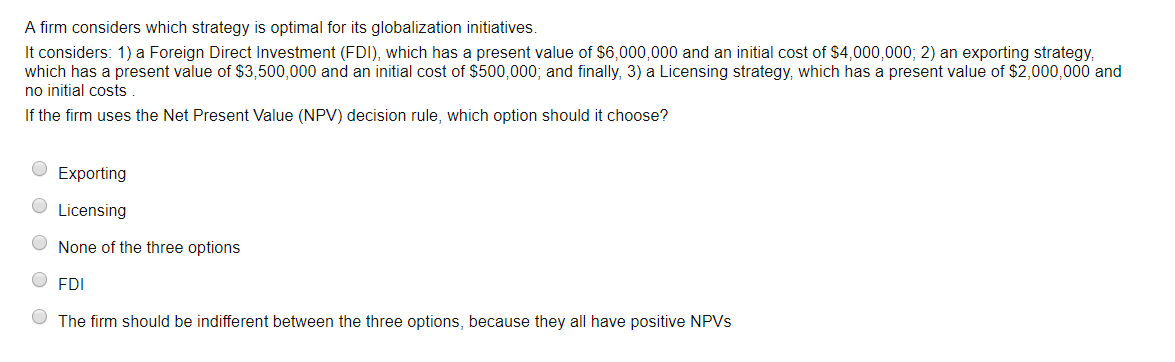

A firm considers which strategy is optimal for its globalization initiatives It considers: 1) a Foreign Direct Investment (FDI), which has a present value of $6,000,000 and an initial cost of $4,000,000; 2) an exporting strategy, which has a present value of $3,500,000 and an initial cost of $500,000, and finally, 3) a Licensing strategy, which has a present value of $2,000,000 and no initial costs If the firm uses the Net Present Value (NPV) decision rule, which option should it choose? Exporting Licensing None of the three options OFDI The firm should be indifferent between the three options, because they all have positive NPVs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts