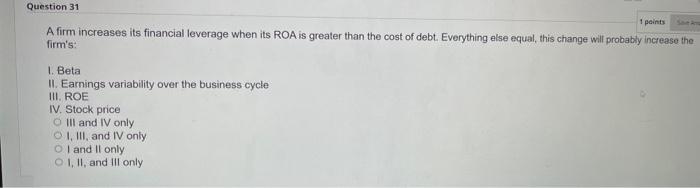

Question: A firm increases its financial leverage when its ROA is greater than the cost of debt. Everything else equal, this change will probabily increase the

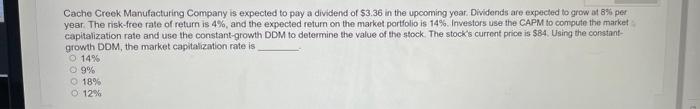

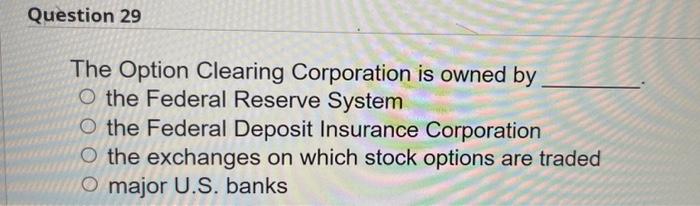

A firm increases its financial leverage when its ROA is greater than the cost of debt. Everything else equal, this change will probabily increase the firm's: 1. Beta II. Earnings variability over the business cycle III. ROE IV. Stock price III and IV only I. III, and IV only I and II only I, II, and III only Cache Creek Manufacturing Company is expected to pay a dividend of $3.36 in the upcoming year. Dividends are expected to grow at 8% per year. The risk-free rate of return is 4%, and the expected return on the market portfolio is 14%. Investors use the CAPM to compute the market capitalization rate and use the constant-growth DDM to determine the value of the stock. The stock's current price is \$84. Using the constantgrowth DDM, the market capitalization rate is 14% 9% 18% 12% The Option Clearing Corporation is owned by the Federal Reserve System the Federal Deposit Insurance Corporation the exchanges on which stock options are traded major U.S. banks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts