Question: only question 9. only question 3 A firm increases its financial leverage when its ROA is greater than the cost of debt. Everything else equal

only question 9.

only question 9. only question 3

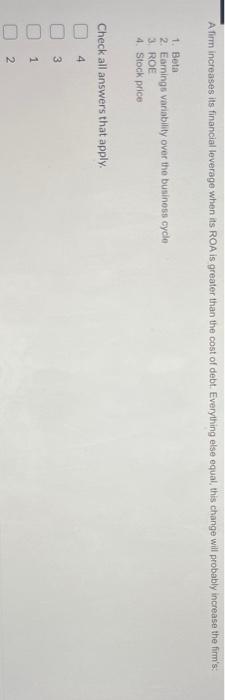

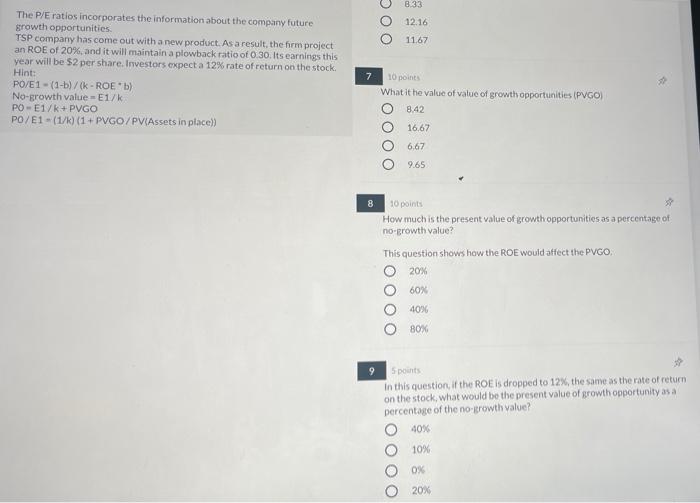

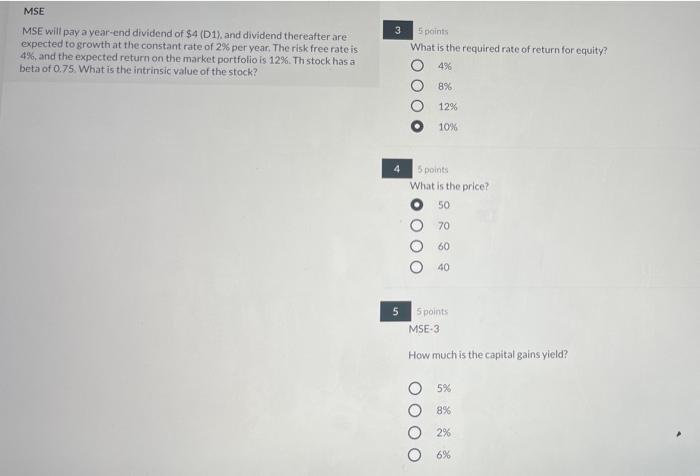

only question 3A firm increases its financial leverage when its ROA is greater than the cost of debt. Everything else equal this change will probably increase the firm's 1. Beta 2. Earings variability over the business cycle 3 ROE 4. Stock price Check all answers that apply. 4 3 1 2 8.33 12.16 11.67 The P/E ratios incorporates the information about the company future growth opportunities TSP company has come out with a new product. As a result, the firm project an ROE of 20%, and it will maintain a plowback ratio of 0.30. Its earnings this year will be $2 per share. Investors expect a 12% rate of return on the stock. Hint: PO/E1 - (1-b)/(k - ROE"b) No-growth value=E1/k PO - E1/k+PVGO PO/E1-(1/6) (1+PVGO/PV/Assets in place) 10 points What it he value of value of growth opportunities (PVGO) 8.42 16.67 OOOO 6,67 9.65 8 10 points How much is the present value of growth opportunities as a percentage of no-growth value? This question shows how the ROE would affect the PVGO. 20% 60% 40% 80% 5 points In this question, if the Roe is dropped to 12%, the same as the rate of return on the stock, what would be the present value of growth opportunity as a percentage of the no- growth value? 40% 10% 0% 20% 3 MSE MSE will pay a year-end dividend of $4 (D1), and dividend thereafter are expected to growth at the constant rate of 2% per year. The risk free rate is 4%, and the expected return on the market portfolio is 12%. Thstock has a beta of 0.75. What is the intrinsic value of the stock? 5 points What is the required rate of return for equity? 436 8% OOOO 12% 10% 5 points What is the price? 50 70 60 40 5 Spoints MSE-3 How much is the capital gains yield? 5% 8% 2% 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts