A Firm intends to invest some capital for a period of 15 years; the Firm's Management...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

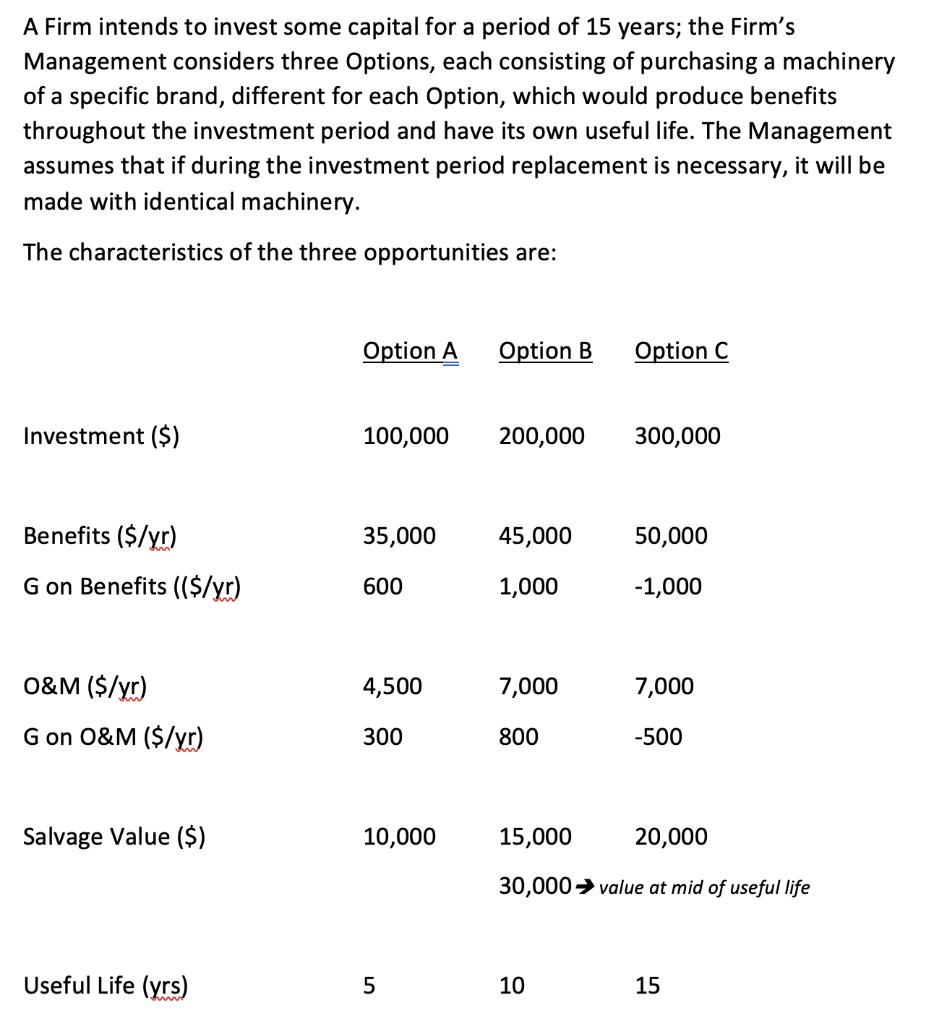

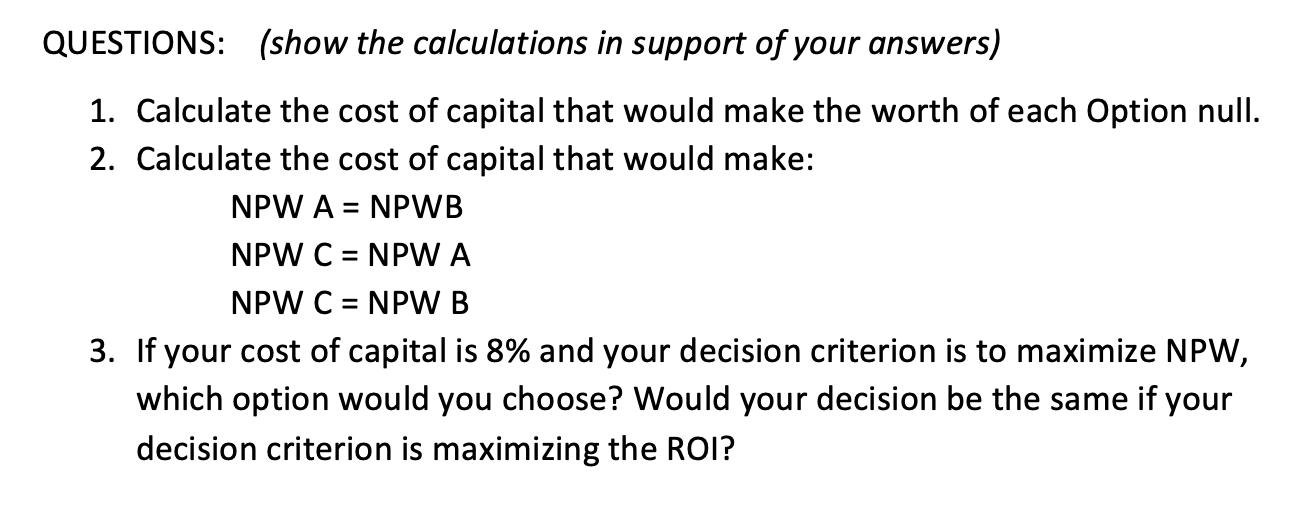

A Firm intends to invest some capital for a period of 15 years; the Firm's Management considers three Options, each consisting of purchasing a machinery of a specific brand, different for each Option, which would produce benefits throughout the investment period and have its own useful life. The Management assumes that if during the investment period replacement is necessary, it will be made with identical machinery. The characteristics of the three opportunities are: Investment ($) Benefits ($/yr) G on Benefits (($/yr) O&M ($/yr) G on O&M ($/yr) Salvage Value ($) Useful Life (yrs) Option A Option B 100,000 35,000 600 4,500 300 10,000 5 200,000 45,000 1,000 7,000 800 Option C 10 300,000 50,000 -1,000 7,000 -500 15,000 20,000 30,000 ➜value at mid of useful life 15 QUESTIONS: (show the calculations in support of your answers) 1. Calculate the cost of capital that would make the worth of each Option null. 2. Calculate the cost of capital that would make: NPW A = NPWB NPW C = NPW A NPW C = NPW B 3. If your cost of capital is 8% and your decision criterion is to maximize NPW, which option would you choose? Would your decision be the same if your decision criterion is maximizing the ROI? A Firm intends to invest some capital for a period of 15 years; the Firm's Management considers three Options, each consisting of purchasing a machinery of a specific brand, different for each Option, which would produce benefits throughout the investment period and have its own useful life. The Management assumes that if during the investment period replacement is necessary, it will be made with identical machinery. The characteristics of the three opportunities are: Investment ($) Benefits ($/yr) G on Benefits (($/yr) O&M ($/yr) G on O&M ($/yr) Salvage Value ($) Useful Life (yrs) Option A Option B 100,000 35,000 600 4,500 300 10,000 5 200,000 45,000 1,000 7,000 800 Option C 10 300,000 50,000 -1,000 7,000 -500 15,000 20,000 30,000 ➜value at mid of useful life 15 QUESTIONS: (show the calculations in support of your answers) 1. Calculate the cost of capital that would make the worth of each Option null. 2. Calculate the cost of capital that would make: NPW A = NPWB NPW C = NPW A NPW C = NPW B 3. If your cost of capital is 8% and your decision criterion is to maximize NPW, which option would you choose? Would your decision be the same if your decision criterion is maximizing the ROI?

Expert Answer:

Related Book For

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham

Posted Date:

Students also viewed these accounting questions

-

A firm intends to choose the best offer (or ranking of the offers) from the set of proposals submitted by potential contractors. Two experts evaluate five proposals using several criteria. In order...

-

What strategies can Ernie Higa use to address the labor shortage problem? What the United States labor initiatives can be exported into Japan and why?

-

If 500 g of brass at 200C and 300 g of steel at 150C are added to 900 g of water in an aluminum pan of mass 150 g both at 20.0C, find the final temperature, assuming no loss of heat to the...

-

A chemical is spilled into a lake of pure water and the concentration of chemicals in this lake is 4 If 20 of the water in the lake is replaced with clean in one month then. What will be the...

-

In Figure particle 1 of charge q 1 = 1.00pC and particle 2 of charge q 1 = ? 2.00pC are fixed at a distance d = 5.00 cm apart. In unit-vector notation, what is the net electric field at points?? (a)...

-

A magazine publisher is studying the influence of type style and darkness on the readability of her publication. Each of 12 persons has been randomly assigned to one of the cells in the experiment,...

-

R5

-

1. In its opinion, the court pointed out that the duty to act in good faith does not apply to lenders seeking payment on demand notes. Why not? 2. If National City had demanded payment of the line...

-

(1x4=5Marks) define business process modelling with the help of types of Business Models? (2x3=5Marks) How to create relationship in Microsoft Access, explain your answer with the help of necessary...

-

The next diagram depicts a system of aqueducts that originate at three rivers (nodes R1, R2, and R3) and terminate at a major city (node T), where the other nodes are junction points in the system....

-

A flower bed is in the shape of a triangle with one side twice the length of the shortest side and the third side is 14 feet more than the length of the shortest side. the dimensions if the perimeter...

-

Explain the principles of database normalization and denormalization, delineating their respective roles in optimizing data storage efficiency, query performance, and data integrity in relational...

-

Asymptotic Computational Complexity O(): Calculate the time complexity of each function below and explain your reasoning. Write your answers on paper and submit a scanned copy. (5 pts each) def...

-

Happy Valley Software has developed a new meteorology software package that will likely revolutionize the weather forecasting industry. They are looking to market the software to the following three...

-

Please read the essay Nasty Women Have Much Work To Do from Alexandra Petri on pages 45-47. In your discussion post, please share your thoughts on what specific strategies she uses to create tone and...

-

We live in an increasingly hyper-competitive global marketplace, where firms are fighting to stay lean and flexible in an effort to satisfy increasingly diverse and specialized consumer demand. In...

-

Fragrances Corporation is an international manufacturer of fragrances for women. Management is considering expanding the product line to mens fragrances. From the best estimates of the marketing and...

-

The percentage of completion and completed contract methods are described in the FASB ASC. Search the codification to find the paragraphs covering these topics, cite them, and copy the results.

-

Compare the capital structures of the following firms and answer the related questions: General Motors Corporation [GM], an automobile manufacturing and financing firm; Walt Disney Company [DIS], an...

-

Use the model in File C15 to solve this problem. a. Refer back to Problem 15-8. Suppose that by offering a 2 percent cash discount for paying within the month of sale, the credit manager of Carols...

-

Van Auken Lumbers 2009 income statement is shown here: Sales........................................................................ $36,000 Cost of goods...

-

List the tools and techniques for performing risk control. LO.1

-

Discuss the common sources of risk on IT projects and suggestions for managing them. Which suggestions do you find most useful? Which do you feel would not work in your organization? Why? LO.1

-

Describe how to use a probability/impact matrix and the Top Ten Risk Item Tracking approaches for performing qualitative risk analysis. How could you use each technique on a project? LO.1

Study smarter with the SolutionInn App