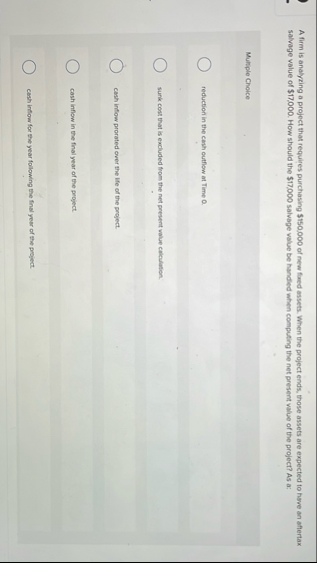

Question: A firm is analyzing a project that requires purchasing $ 1 5 0 . 0 0 0 of new flaed assets. When the project ends,

A firm is analyzing a project that requires purchasing $ of new flaed assets. When the project ends, those assets are expected to heve an affertax salvage value of $ How should the $ salvage value be handied when computing the net present value of the project? As a:

Multiple Choice

reduction in the carh outfow at Time

surk coat that is excluded from the net present value calculation.

cash inflow prorated over the life of the project.

cash inflow in the final year of the project.

Cash intlow for the year following the find year of the project.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock