Question: please answer all 4 multiple choice questions 5 points COB preferred stock has an 8% stated dividend percentage, and a $100 par value. What is

please answer all 4 multiple choice questions

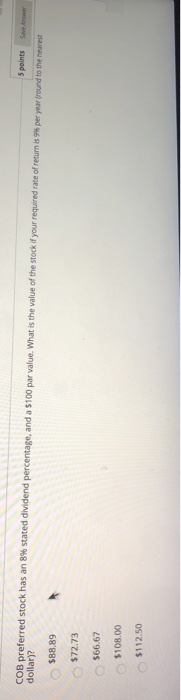

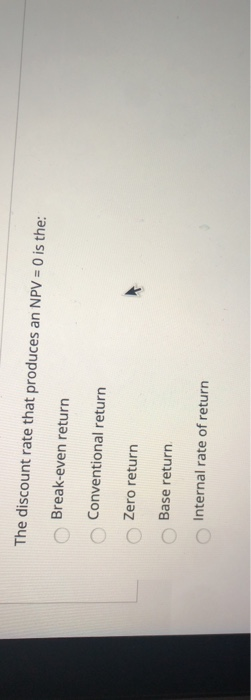

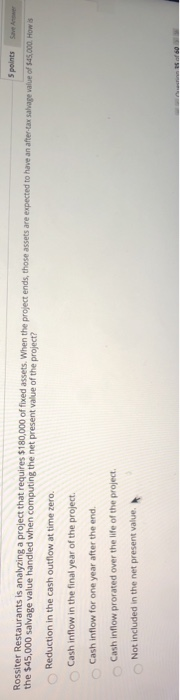

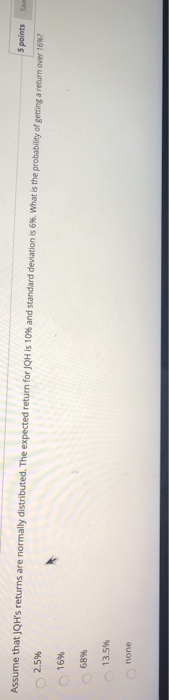

please answer all 4 multiple choice questions 5 points COB preferred stock has an 8% stated dividend percentage, and a $100 par value. What is the value of the stock if your required rate of return is per year round to the nearest dollar)? $88.89 $72.73 $66.67 $108.00 $112.50 The discount rate that produces an NPV = 0 is the: Break-even return Conventional return Zero return Base return Internal rate of return 5 points Rossiter Restaurants is analyzing a project that requires $180,000 of fixed assets. When the project ends, those assets are expected to have an after-tax salvage value of 545,000. How is the $45,000 salvage value handled when computing the net present value of the project? Reduction in the cash outflow at time zero. Cash inflow in the final year of the project. Cash inflow for one year after the end. Cash inflow prorated over the life of the project. Not included in the net present value. Save 5 points Assume that JQH's returns are normally distributed. The expected return for QH is 10% and standard deviation is 6%. What is the probability of getting a return over 1612 2.596 16% 68% 13.5% none

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts