Question: A firm is considering a project that will require an immediate payment of $520. It will then produce two identical cash flows of $100. Then

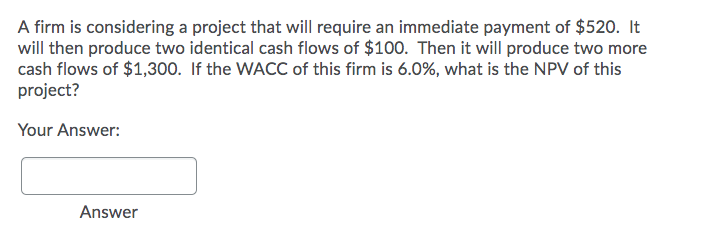

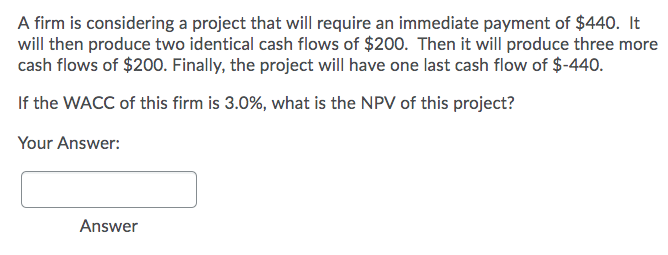

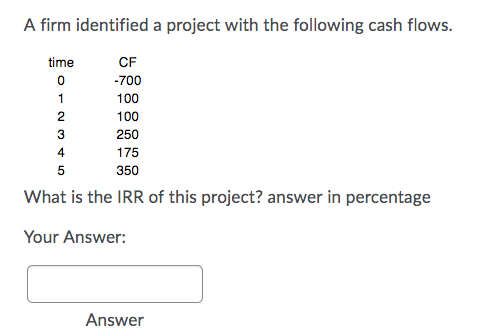

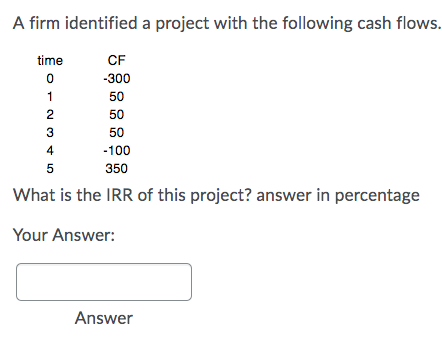

A firm is considering a project that will require an immediate payment of $520. It will then produce two identical cash flows of $100. Then it will produce two more cash flows of $1,300. If the WACC of this firm is 6.0%, what is the NPV of this project? Your Answer: Answer A firm is considering a project that will require an immediate payment of $440. It will then produce two identical cash flows of $200. Then it will produce three more cash flows of $200. Finally, the project will have one last cash flow of $-440. If the WACC of this firm is 3.0%, what is the NPV of this project? Your Answer: Answer A firm identified a project with the following cash flows. O time CF 0 -700 1 100 2 100 250 175 5 350 What is the IRR of this project? answer in percentage AWN 5 Your Answer: Answer A firm identified a project with the following cash flows. CF time -300 50 50 50 -100 350 What is the IRR of this project? answer in percentage OL 1 2 3 4 5 Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts