Question: A firm is considering a project that will require an immediate payment of $360. It will then produce four identical cash flows of $480. Then

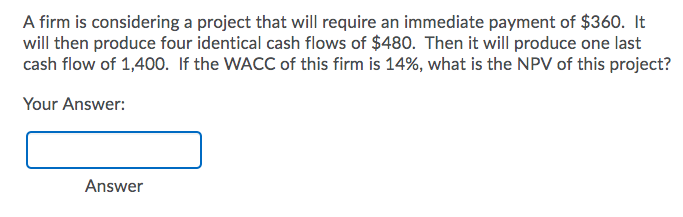

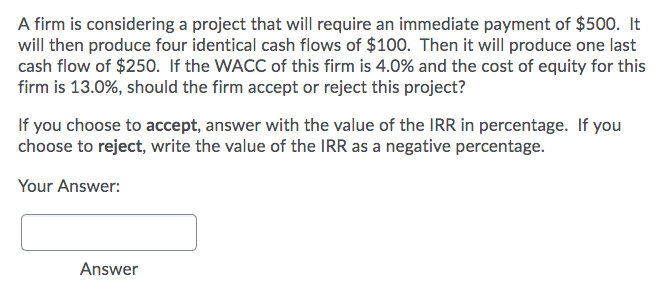

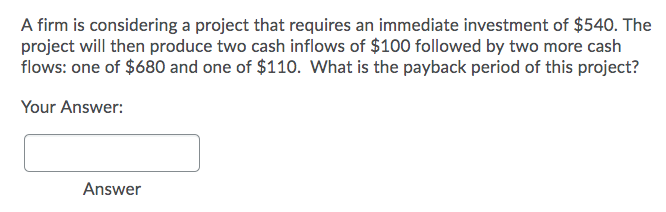

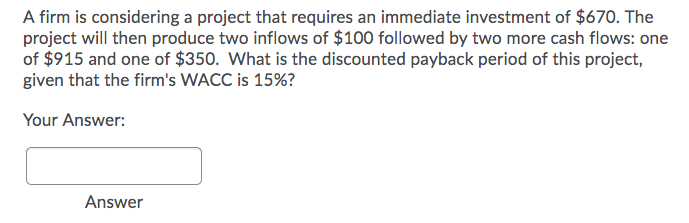

A firm is considering a project that will require an immediate payment of $360. It will then produce four identical cash flows of $480. Then it will produce one last cash flow of 1,400. If the WACC of this firm is 14%, what is the NPV of this project? Your Answer: Answer A firm is considering a project that will require an immediate payment of $500. It will then produce four identical cash flows of $100. Then it will produce one last cash flow of $250. If the WACC of this firm is 4.0% and the cost of equity for this firm is 13.0%, should the firm accept or reject this project? If you choose to accept, answer with the value of the IRR in percentage. If you choose to reject, write the value of the IRR as a negative percentage. Your Answer: Answer A firm is considering a project that requires an immediate investment of $540. The project will then produce two cash inflows of $100 followed by two more cash flows: one of $680 and one of $110. What is the payback period of this project? Your Answer: Answer A firm is considering a project that requires an immediate investment of $670. The project will then produce two inflows of $100 followed by two more cash flows: one of $915 and one of $350. What is the discounted payback period of this project, given that the firm's WACC is 15%? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts