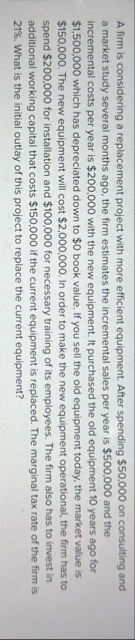

Question: A firm is considering a replacement project with more efficient equipment. After spending $ 5 0 , 0 0 0 on consulting and a market

A firm is considering a replacement project with more efficient equipment. After spending $ on consulting and a market study several months ago, the firm estimates the incremental sales per year is $ and the incremental costs per year is $ with the new equipment. It purchased the old equipment years ago for $ which has depreciated down to $ book value. If you sell the old equipment today, the market value is $ The new equipment will cost $ In order to make the new equipment operational, the firm has to spend $ for installation and $ for necessary training of its employees. The firm also has to invest in additional working capital that costs $ if the current equipment is replaced. The marginal tax rate of the firm is What is the initial outlay of this project to replace the current equipment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock