Question: A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach

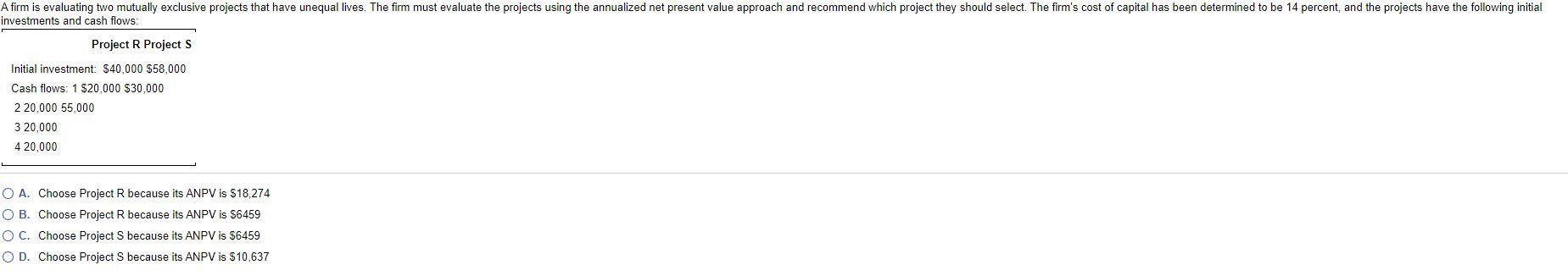

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows: Project R Project S Initial investment: $40,000 $58,000 Cash flows: 1 $20,000 $30,000 220,000 55,000 3 20.000 420,000 O A. Choose Project R because its ANPV is $18,274 O B. Choose Project R because its ANPV is 56459 OC. Choose Project S because its ANPV is $6459 OD. Choose Project S because its ANPV is $10,637

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts