Question: Part Two: Problems (60%): Write down your answers in the following two answer sheets. You have to show me your work to get credits. Question

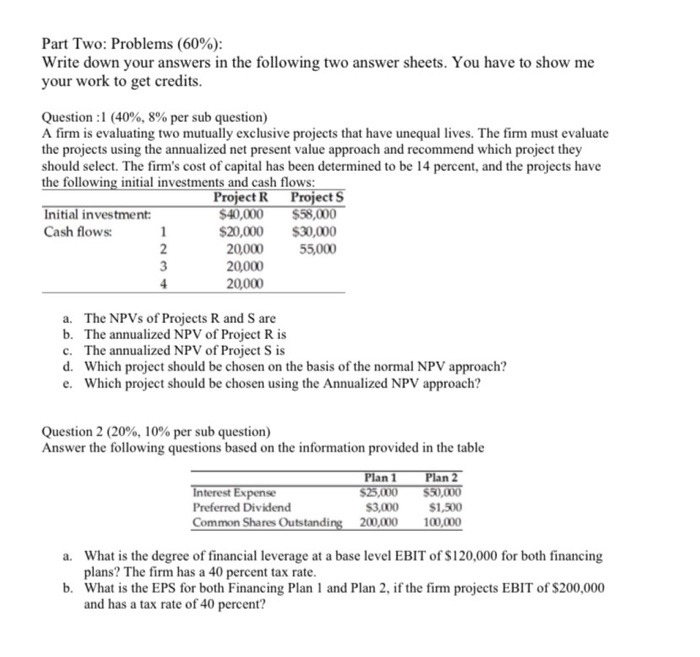

Part Two: Problems (60%): Write down your answers in the following two answer sheets. You have to show me your work to get credits. Question :1 (40%, 8% per sub question) A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows: Project R Projects Initial investment: $40,000 $58,000 Cash flows: $20,000 $30,000 20,000 55,000 20,000 20,000 a. The NPVs of Projects R and S are b. The annualized NPV of Project R is c. The annualized NPV of Project S is d. Which project should be chosen on the basis of the normal NPV approach? e. Which project should be chosen using the Annualized NPV approach? Question 2 (20%, 10% per sub question) Answer the following questions based on the information provided in the table Interest Expense Preferred Dividend Common Shares Outstanding Plan 1 $25,000 $3,000 200,000 Plan 2 $30,000 $1,500 100,000 a. What is the degree of financial leverage at a base level EBIT of $120,000 for both financing plans? The firm has a 40 percent tax rate. b. What is the EPS for both Financing Plan 1 and Plan 2, if the firm projects EBIT of $200,000 and has a tax rate of 40 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts