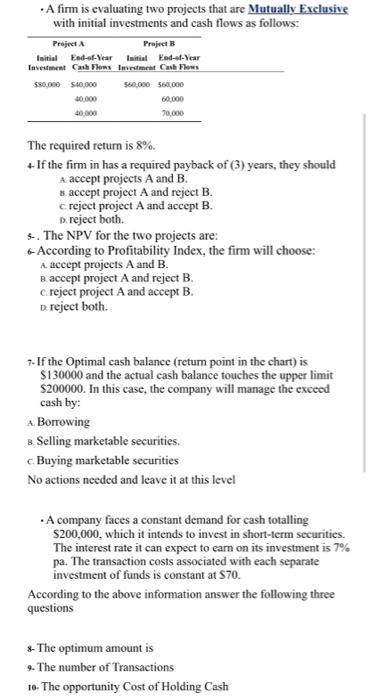

Question: A firm is evaluating two projects that are Mutually Exclusive with initial investments and cash flows as follows: Project Project B Initial End-of-Year Initial End-of-Year

A firm is evaluating two projects that are Mutually Exclusive with initial investments and cash flows as follows: Project Project B Initial End-of-Year Initial End-of-Year Investment Cash Flows Investment Cash Flows $80.000 500.000 560.000 560,000 60,000 40,000 70,000 The required return is 8% + If the firm in has a required payback of (3) years, they should A accept projects A and B accept project A and reject B. creject project A and accept B. Dreject both. 5. The NPV for the two projects are: According to profitability Index, the firm will choose: A accept projects A and B. B accept project A and reject B. c reject project A and accept B. D reject both 7- If the Optimal cash balance (return point in the chart) is $130000 and the actual cash balance touches the upper limit $200000. In this case, the company will manage the exceed cash by: A Borrowing Selling marketable securities. c Buying marketable securities No actions needed and leave it at this level A company faces a constant demand for cash totalling $200,000, which it intends to invest in short-term securities. The interest rate it can expect to earn on its investment is 7% pa. The transaction costs associated with each separate investment of funds is constant at $70. According to the above information answer the following three questions * The optimum amount is 2. The number of Transactions 10- The opportunity Cost of Holding Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts