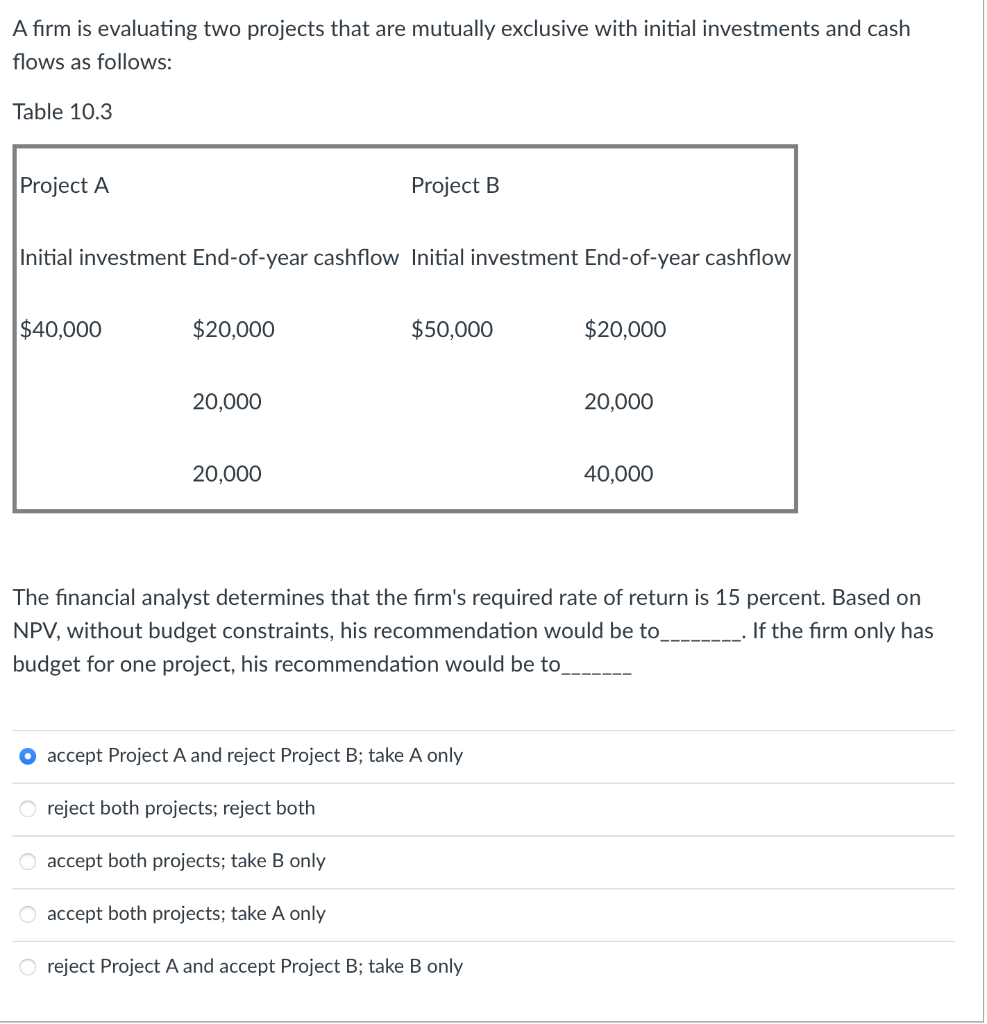

Question: A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Table 10.3 Project A Project B Initial

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Table 10.3 Project A Project B Initial investment End-of-year cashflow Initial investment End-of-year cashflow $40,000 $20,000 $50,000 $20,000 20,000 20,000 20,000 40,000 The financial analyst determines that the firm's required rate of return is 15 percent. Based on NPV, without budget constraints, his recommendation would be to If the firm only has budget for one project, his recommendation would be to accept Project A and reject Project B; take A only O reject both projects; reject both accept both projects; take B only o accept both projects; take A only o reject Project A and accept Project B; take B only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts