Question: A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: a) If the firm in the table

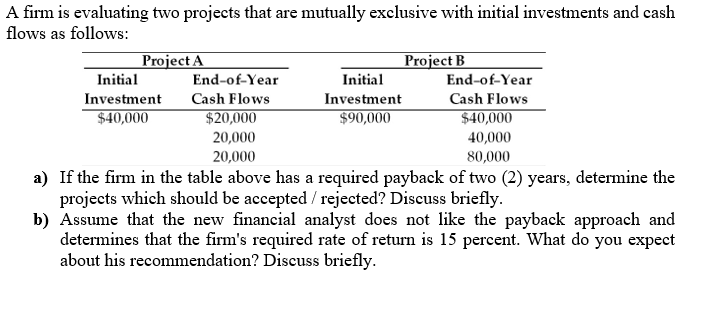

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: a) If the firm in the table above has a required payback of two (2) years, determine the projects which should be accepted / rejected? Discuss briefly. b) Assume that the new financial analyst does not like the payback approach and determines that the firm's required rate of return is 15 percent. What do you expect about his recommendation? Discuss briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts