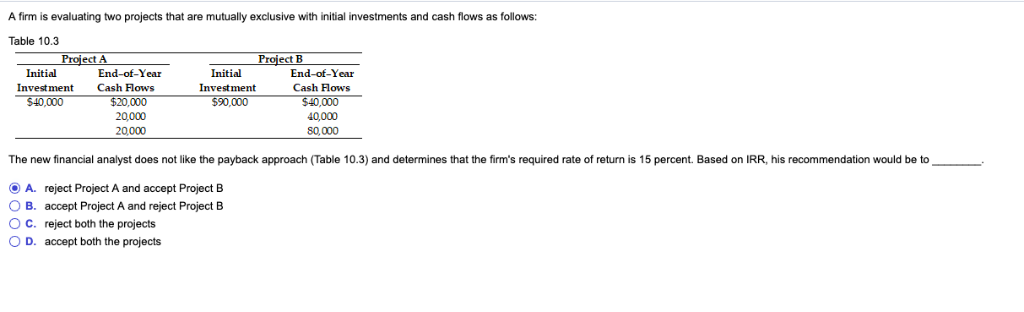

Question: A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Table 10.3 Project A Project B Initial

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows: Table 10.3 Project A Project B Initial Investment Initial End-of-Year End-of-Year Cash Hows $40,000 40,000 80,000 Investment Cash Flows 20,000 20,000 The new financial analyst does not like the payback approach (Table 10.3) and determines that the firm's required rate of return is 15 percent. Based on IRR, his recommendation would be to A. reject Project A and accept Project B B. accept Project A and reject Project B O c. reject both the projects D. accept both the projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts