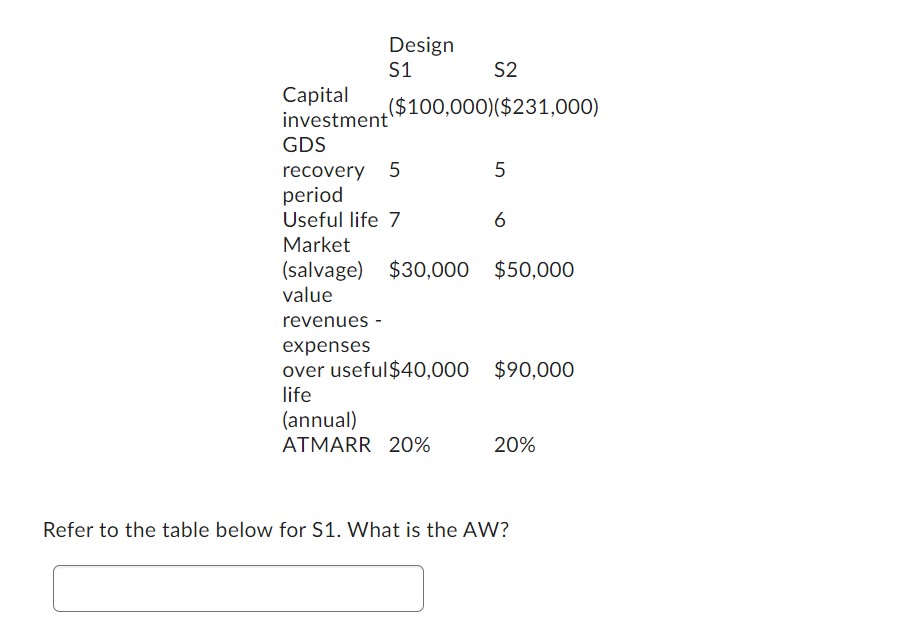

Question: A firm must decide between two system designs with unequal useful lives, S1 and S2, shown below. Their effective income tax rate is 40%, and

A firm must decide between two system designs with unequal useful lives, S1 and S2, shown below. Their effective income tax rate is 40%, and MACRS (GDS) depreciation is used. If the after-tax desired return on investment is 20% per year (ATMARR), which design should be chosen?

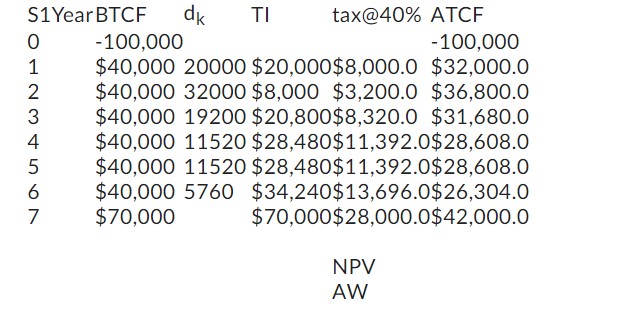

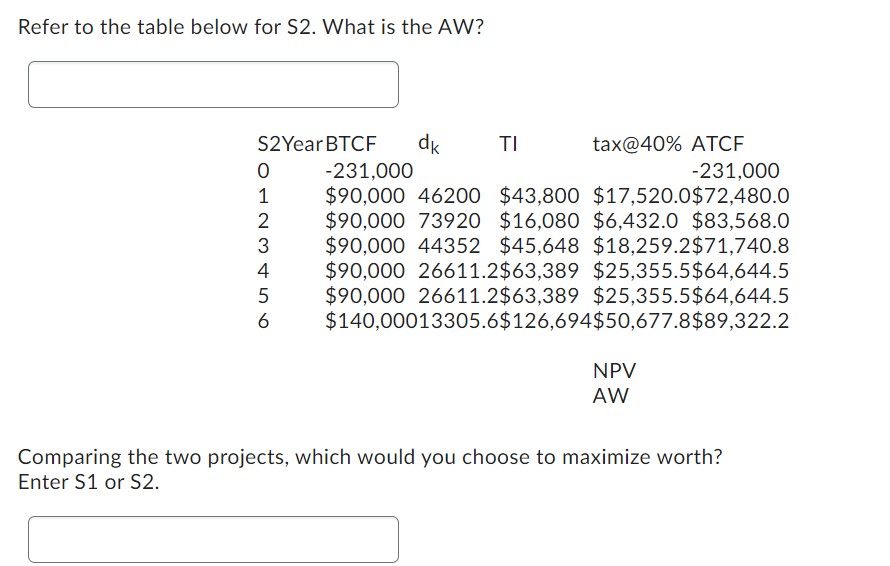

Refer to the table below for S1. What is the AW? NPV AW Refer to the table below for S2. What is the AW? NPV AW Comparing the two projects, which would you choose to maximize worth? Enter S1 or S2. Refer to the table below for S1. What is the AW? NPV AW Refer to the table below for S2. What is the AW? NPV AW Comparing the two projects, which would you choose to maximize worth? Enter S1 or S2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts