Question: A firm must decide whether to build a small, medium, or large stamping plant. A consultant's report indicates that there is a . 2 0

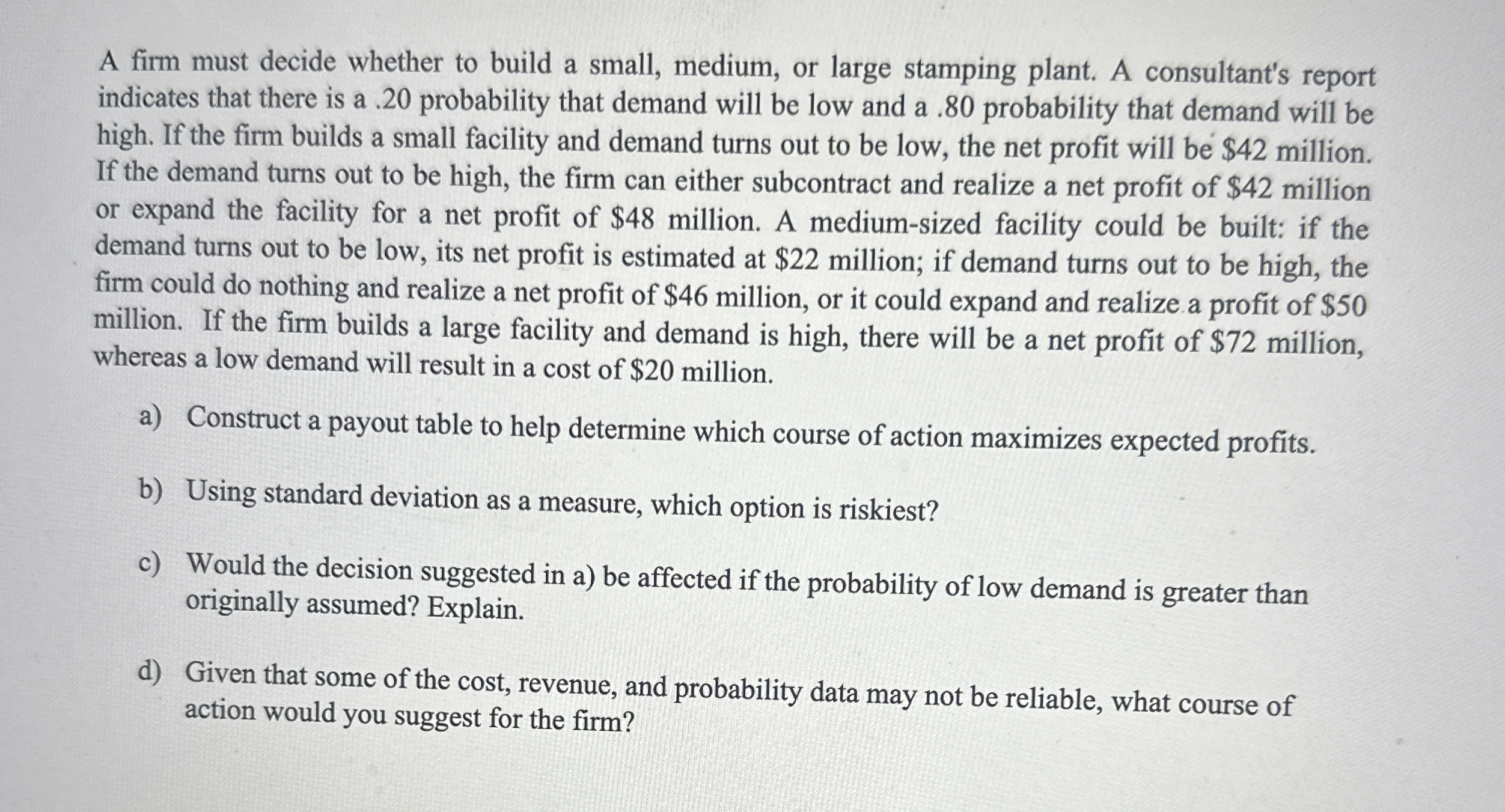

A firm must decide whether to build a small, medium, or large stamping plant. A consultant's report indicates that there is a probability that demand will be low and a probability that demand will be high. If the firm builds a small facility and demand turns out to be low, the net profit will be $ million. If the demand turns out to be high, the firm can either subcontract and realize a net profit of $ million or expand the facility for a net profit of $ million. A mediumsized facility could be built: if the demand turns out to be low, its net profit is estimated at $ million; if demand turns out to be high, the firm could do nothing and realize a net profit of $ million, or it could expand and realize a profit of $ million. If the firm builds a large facility and demand is high, there will be a net profit of $ million, whereas a low demand will result in a cost of $ million.

a Construct a payout table to help determine which course of action maximizes expected profits.

b Using standard deviation as a measure, which option is riskiest?

c Would the decision suggested in a be affected if the probability of low demand is greater than originally assumed? Explain.

d Given that some of the cost, revenue, and probability data may not be reliable, what course of action would you suggest for the firm?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock