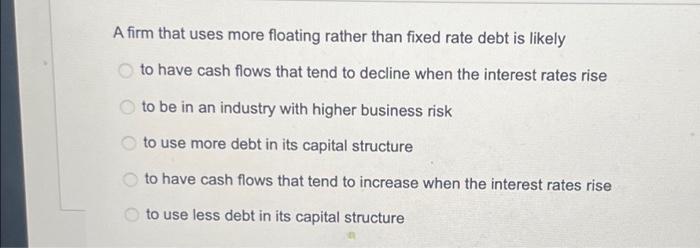

Question: A firm that uses more floating rather than fixed rate debt is likely to have cash flows that tend to decline when the interest rates

A firm that uses more floating rather than fixed rate debt is likely to have cash flows that tend to decline when the interest rates rise to be in an industry with higher business risk to use more debt in its capital structure to have cash flows that tend to increase when the interest rates rise to use less debt in its capital structure

A firm that uses more floating rather than fixed rate debt is likely to have cash flows that tend to decline when the interest rates rise to be in an industry with higher business risk to use more debt in its capital structure to have cash flows that tend to increase when the interest rates rise to use less debt in its capital structure

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock