Question: A firm undertakes a five-year project that requires an initial capital investment of $140,000. The project is then expected to provide incremental free cash flow

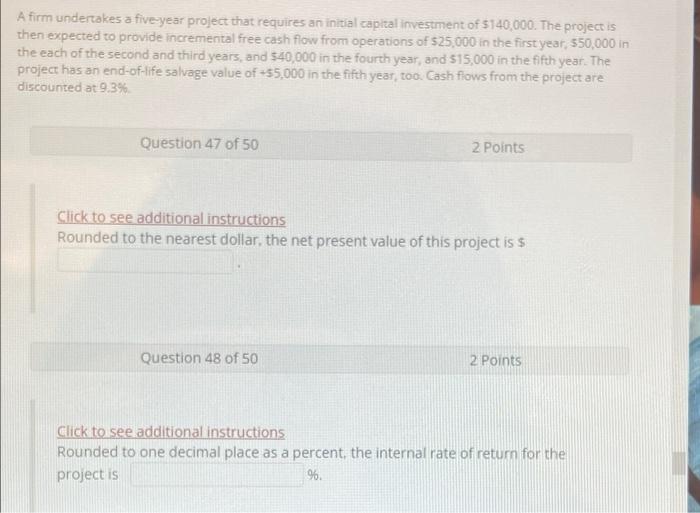

A firm undertakes a five-year project that requires an initial capital investment of $140,000. The project is then expected to provide incremental free cash flow from operations of $25,000 in the first year, 550,000 in the each of the second and third years, and 540,000 in the fourth year, and 515,000 in the fifth year. The project has an end-of-life salvage value of 55,000 in the fifth year, too. Cash flows from the project are discounted at 9.3% Question 47 of 50 2 Points Click to see additional instructions Rounded to the nearest dollar, the net present value of this project is $ Question 48 of 50 2 Points Click to see additional instructions Rounded to one decimal place as a percent, the internal rate of return for the project is %. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts