Question: MULTIPLE CHOICE. C the question. hoose the one alternative that best completes the statement or answers 1) You are offered an investment opportunity that costs

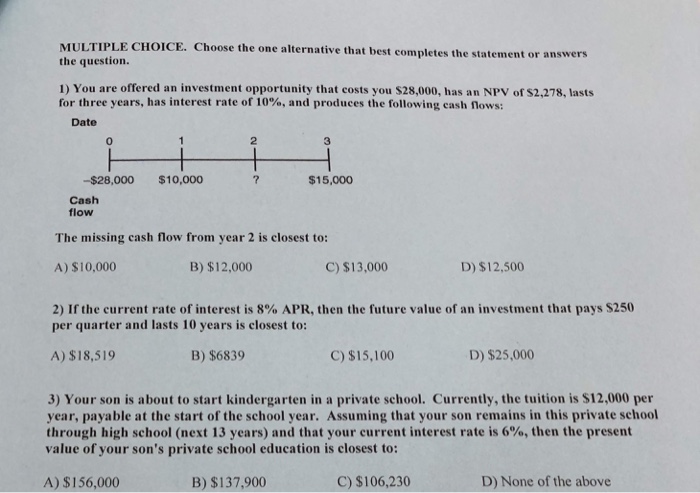

MULTIPLE CHOICE. C the question. hoose the one alternative that best completes the statement or answers 1) You are offered an investment opportunity that costs you $28,000, has an NPV of S2,278, lasts for three years, has interest rate of 10%, and produces the following cash nows: Date 0 2 3 -$28,000 $10,000 $15,000 Cash flow The missing cash flow from year 2 is closest to: A) $10,000 B) $12,000 C) $13,000 D) $12,500 2) If the current rate of interest is 8% APR, then the future value of an investment that pays S250 per quarter and lasts 10 years is closest to: A) $18,519 B) $6839 C) $15,100 D) $25,000 3) Your son is about to start kindergarten in a private school. Currently, the tuition is $12,000 per year, payable at the start of the school year. Assuming that your son remains in this private sehool through high school (next 13 years) and that your current interest rate is 6%, then the present value of your son's private school education is closest to: A) $156,000 B) $137,900 C) S106,230 D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts