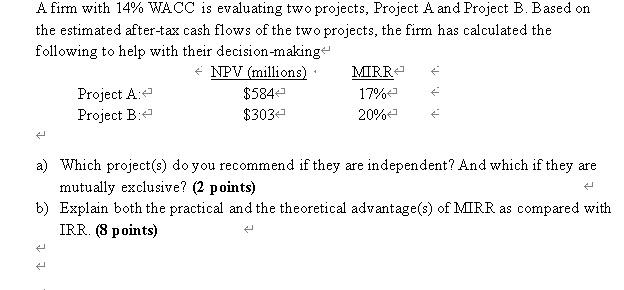

Question: A firm with 14% WACC is evaluating two projects, Project A and Project B. Based on the estimated after-tax cash flows of the two projects,

A firm with 14% WACC is evaluating two projects, Project A and Project B. Based on the estimated after-tax cash flows of the two projects, the firm has calculated the following to help with their decision-making NPV (millions) MIRR Project A4 $5842 17% Project B: $3032 20% a) Which project(s) do you recommend if they are independent? And which if they are mutually exclusive? (2 points) b) Explain both the practical and the theoretical advantage(s) of MRR as compared with IRR (8 points) A firm with 14% WACC is evaluating two projects, Project A and Project B. Based on the estimated after-tax cash flows of the two projects, the firm has calculated the following to help with their decision-making NPV (millions) MIRR Project A4 $5842 17% Project B: $3032 20% a) Which project(s) do you recommend if they are independent? And which if they are mutually exclusive? (2 points) b) Explain both the practical and the theoretical advantage(s) of MRR as compared with IRR (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts