Question: A firm with a 11.5% WACC is evaluating two projects for this years capital budget. After-tax cash flows are as follows: a. Calculate NPV, IRR,

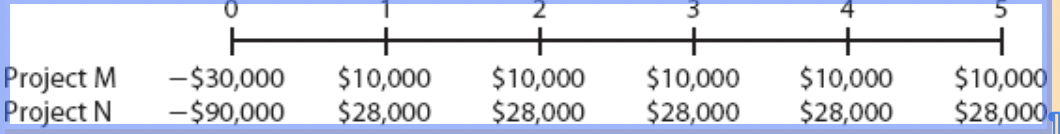

A firm with a 11.5% WACC is evaluating two projects for this years capital budget. After-tax cash flows are as follows:

a. Calculate NPV, IRR, MIRR, payback, and discounted payback for each project.

b. Assuming the projects are independent, which one(s) would you recommend?

c. If the projects are mutually exclusive, which would you recommend?

d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR?

0 2 3 5 Project M Project N -$30,000 - $90,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000 $10,000 $28,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts