Question: A firm with initial equity E has an option to invest in a safe or a risky project, both of which require a loan

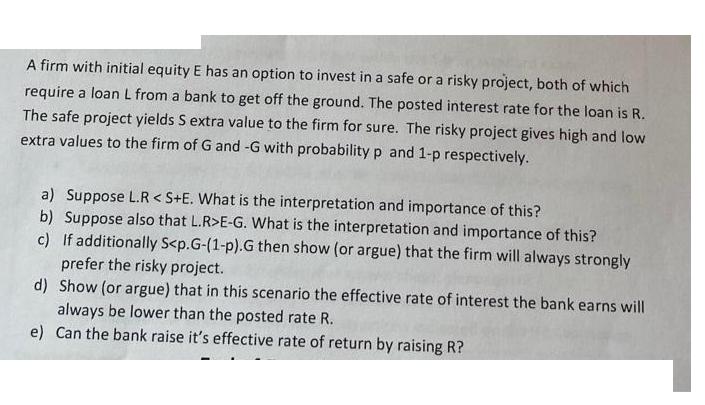

A firm with initial equity E has an option to invest in a safe or a risky project, both of which require a loan L from a bank to get off the ground. The posted interest rate for the loan is R. The safe project yields S extra value to the firm for sure. The risky project gives high and low extra values to the firm of G and -G with probability p and 1-p respectively. a) Suppose L.R E-G. What is the interpretation and importance of this? c) If additionally S

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

a The inequality LR SE indicates that the cost of the loan LR is lower than the expected value of th... View full answer

Get step-by-step solutions from verified subject matter experts