Question: A fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is

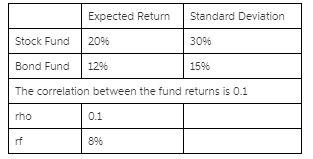

A fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows

1. Find the global minimum variance portfolio (GMVP) using Excel Solver. What is the weight in the stock fund for your GMVP?

2. What is the standard deviation for your GMVP?

3. Find the tangency portfolio using Excel Solver. What is the weight in the stock fund for your tangency portfolio?

Expected Retum Standard Deviation Stock Fund 20% 3096 Bond Fund 1296 1596 The correlation between the fund returns is 0.1 rho 0.1 rf 896 Expected Retum Standard Deviation Stock Fund 20% 3096 Bond Fund 1296 1596 The correlation between the fund returns is 0.1 rho 0.1 rf 896

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts