Question: A G H B D E F The Fallbrook Company, which has been in business for three years, makes all of its sales on account

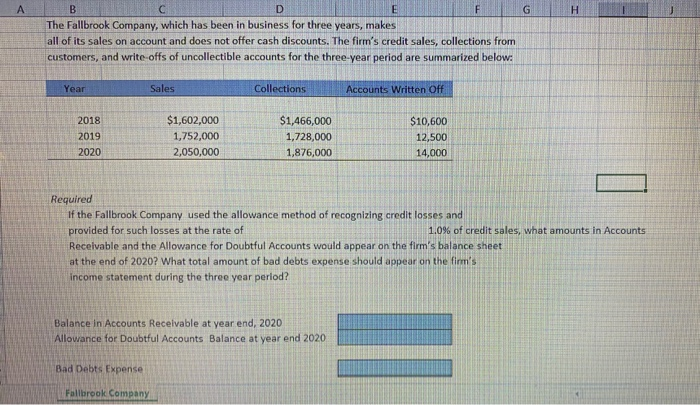

A G H B D E F The Fallbrook Company, which has been in business for three years, makes all of its sales on account and does not offer cash discounts. The firm's credit sales, collections from customers, and write-offs of uncollectible accounts for the three-year period are summarized below: Year Sales Collections Accounts Written Off 2018 2019 2020 $1,602,000 1,752,000 2,050,000 $1,466,000 1,728,000 1,876,000 $10,600 12,500 14,000 Required If the Fallbrook Company used the allowance method of recognizing credit losses and provided for such losses at the rate of 1.0% of credit sales, what amounts in Accounts Receivable and the Allowance for Doubtful Accounts would appear on the firm's balance sheet at the end of 2020? What total amount of bad debts expense should appear on the firm's income statement during the three year period? Balance in Accounts Receivable at year end, 2020 Allowance for Doubtful Accounts Balance at year end 2020 Bad Debts Expense Fallbrook Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts