Question: please help solve! Please help solve, provided clear pictures. B D E m F G von 2 3 Group Project 2 - Mini Case 1

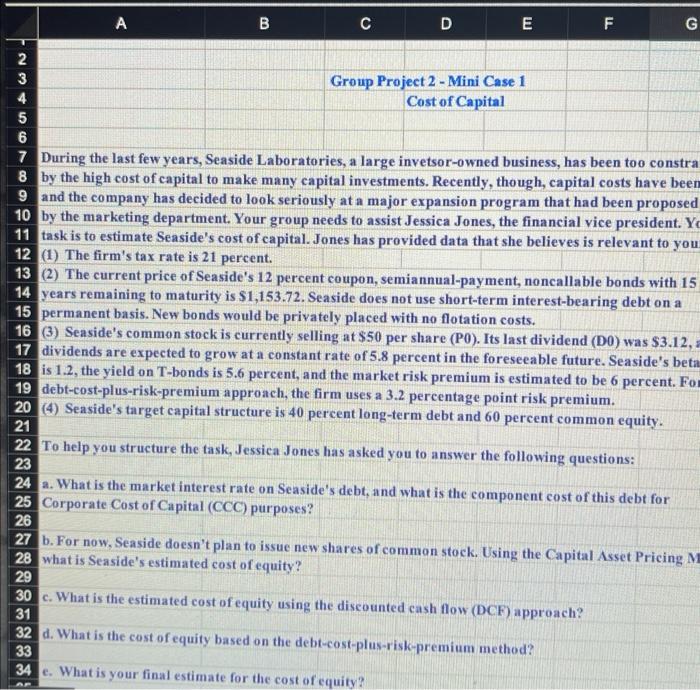

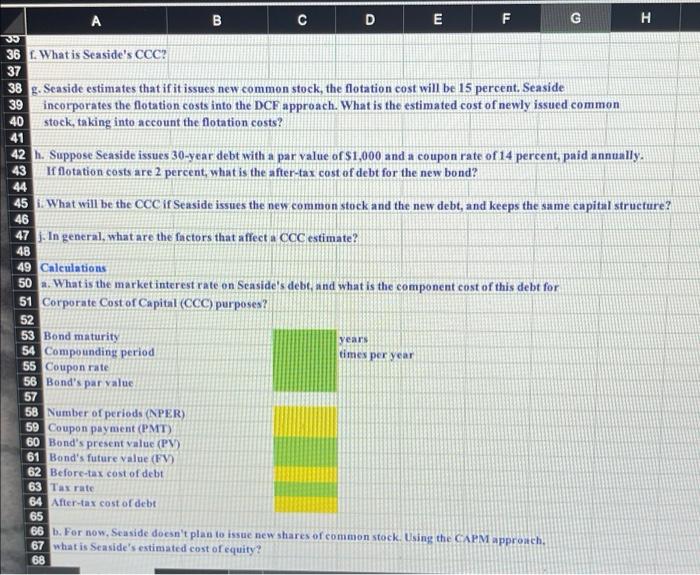

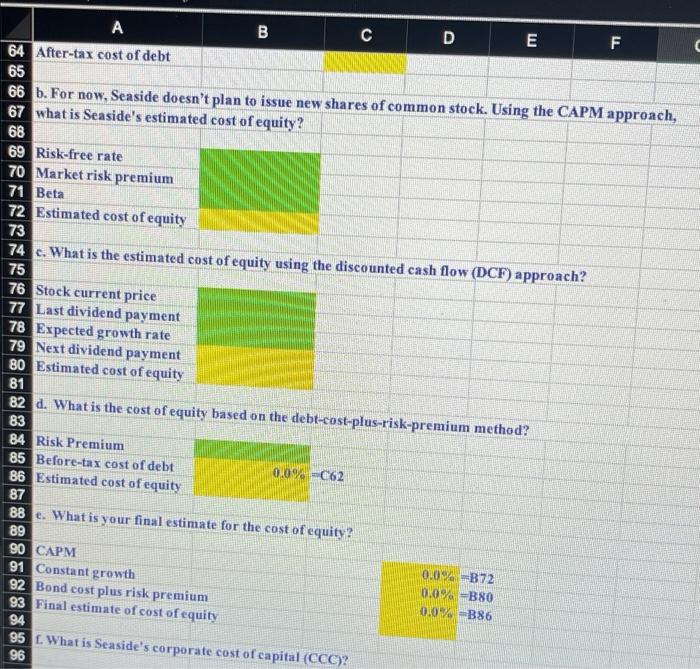

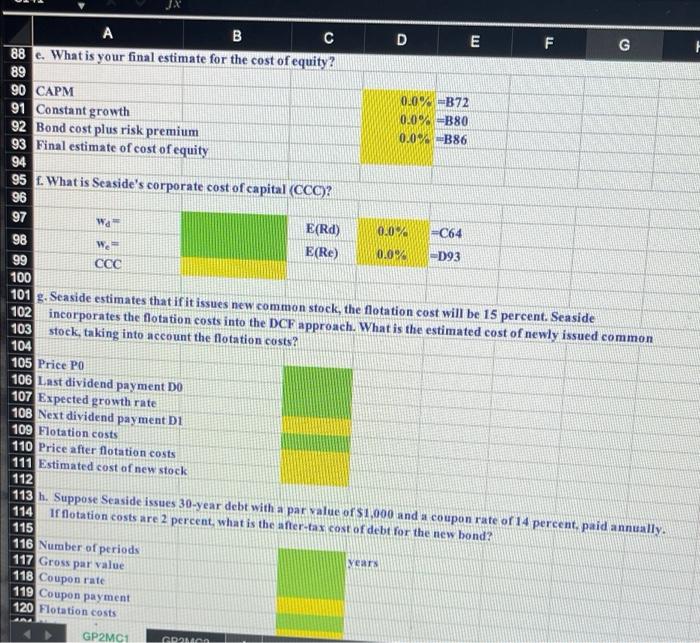

B D E m F G von 2 3 Group Project 2 - Mini Case 1 4 Cost of Capital 5 6 7 During the last few years, Seaside Laboratories, a large invetsor-owned business, has been too constra 8 by the high cost of capital to make many capital investments. Recently, though, capital costs have been 9 and the company has decided to look seriously at a major expansion program that had been proposed 10 by the marketing department. Your group needs to assist Jessica Jones, the financial vice president. Y 11 task is to estimate Seaside's cost of capital. Jones has provided data that she believes is relevant to you 12 (1) The firm's tax rate is 21 percent. 13 (2) The current price of Seaside's 12 percent coupon, semiannual-payment, noncallable bonds with 15 14 years remaining to maturity is $1,153.72. Seaside does not use short-term interest-bearing debt on a 15 permanent basis. New bonds would be privately placed with no flotation costs. 16 (3) Seaside's common stock is currently selling at $50 per share (PO). Its last dividend (DO) was $3.12, 17 dividends are expected to grow at a constant rate of 5.8 percent in the foreseeable future. Seaside's beta 18 is 1.2, the yield on T-bonds is 5.6 percent, and the market risk premium is estimated to be 6 percent. For 19 debt-cost-plus-risk-premium approach, the firm uses a 3.2 percentage point risk premium. 20 (4) Seaside's target capital structure is 40 percent long-term debt and 60 percent common equity. 21 22 To help you structure the task, Jessica Jones has asked you to answer the following questions: 23 24 a. What is the market interest rate on Seaside's debt, and what is the component cost of this debt for 25 Corporate Cost of Capital (CCC) purposes? 26 27 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the Capital Asset Pricing M 28 what is Seaside's estimated cost of equity? 29 30 c. What is the estimated cost of equity using the discounted cash flow (DCF) approach? 31 32 d. What is the cost of equity based on the debt-cost-plus-risk-premium method? 33 34. What is your final estimate for the cost of equity? C G A B D E F H 09 36 . What is Seaside's CCC? 37 38 g. Seaside estimates that if it issues new common stock, the flotation cost will be 15 percent. Seaside 39 incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common 40 stock, taking into account the flotation costs? 41 42 I. Suppose Seaside issues 30-year debt with a par value of $1,000 and a coupon rate of 14 percent, paid annually. 43 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 44 45. What will be the CCC If Seaside issues the new common stock and the new debt, and keeps the same capital structure? 46 47. In general, whatare the factors that affect a CCC estimate? 48 49 Calculations 50 . What is the market interest rate on Seaside's debt, and what is the component cost of this debt for 51 Corporate Cost of Capital (CCC) purposes? 52 53 Bond maturity 54 Compounding period times per year 55 Coupon rate 56 Bond's par value 57 58 Number of periods (NPER) 59 Coupon payment (PMT) 60 Bond's present value (PV) 61 Bond's future value (FV) 62 Before-tax cost of debt 63 Tax rate 64 After-tax cost of debt 65 66 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the CAPM approach. 67 what is Seaside's estimated cost of equity? 68 years B D E F 64 After-tax cost of debt 65 66 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the CAPM approach, 67 what is Seaside's estimated cost of equity? 68 69 Risk-free rate 70 Market risk premium 71 Beta 72 Estimated cost of equity 73 74 . What is the estimated cost of equity using the discounted cash flow (DCF) approach? 75 76 Stock current price 77 Last dividend payment 78 Expected growth rate 79 Next dividend payment 80 Estimated cost of equity 81 82 d. What is the cost of equity based on the debt-cost-plus-risk-premium method? 83 84 Risk Premium 85 Before-tax cost of debt 0.0% =C62 86 Estimated cost of equity 87 88 e. What is your final estimate for the cost of equity! 89 90 CAPM 0.0% =B72 91 Constant growth 0.0%=B80 92 Bond cost plus risk premium 0.0%B86 93 Final estimate of cost of equity 94 95 1. What is Seaside's corporate cost of capital (CCC)? 96 B F G A B C D E F G 88. What is your final estimate for the cost of equity? 89 90 CAPM 0.0%=B72 91 Constant growth 0.0%B80 92 Bond cost plus risk premium 0.0%B86 93 Final estimate of cost of equity 94 95 1. What is Seaside's corporate cost of capital (CCC)? 96 97 Wa E(Rd) 0.0% --C64 98 We E(Re) 0.044 -D93 99 100 101 g. Seaside estimates that if it issues new common stock, the flotation cost will be 15 percent. Seaside 102 incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common 103 stock, taking into account the flotation costs? 104 105 Price PO 106 Last dividend payment DO 107 Expected growth rate 108 Next dividend payment Di 109 Flotation costs 110 Price after flotation costs 111 Estimated cost of new stock 112 113 h. Suppose Seaside issues 30-year debt with a par value of $1.000 and a coupon rate of 14 percent, paid annually. 114 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 115 116 Number of periods Vears 117 Gross par value 118 Coupon rate 119 Coupon payment 120 Flotation costs GP2MC1 CDANAS E G A B C D E F H 709 Flotation costs 110 Price after flotation costs 111 Estimated cost of new stock 112 113 h. Suppose Seaside issues 30-year debt with a par value of $1,000 and a coupon rate of 14 percent, paid annually. 114 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 115 116 Number of periods years 117 Gross par value 118 Coupon rate 119 Coupon payment 120 Flotation costs 121 Net par value 122 Before-tax cost of debt 123 Tax rate 124 After-tax cost of debt 125 126 1. What will be the CCC if Seaside issues the new common stock and the new debt, and keeps the same capital structure? 127 128 E(Rd 0.00% -C124 129 W E(Re) 130 131 132). In general, what are the factors that affect a CCC estimate? (Narrative) 133 134 135 136 137 138 139 140 141 wa 0.0024 CI11 GP2MC1 GP2MC2 : Mal Culo Capital - a naray to date a ni hat a hair Ire Sentet e para, Jalan produselor in hendrer at is the prints platest =m - art is Sedes comprendre som er artists are protein y tatar arintain - Thaai praiseitte htt-sail-plant-ri pey (4 Shats is a parat team di nee inai, hara thaan kart attest pain are alageni ( Center , 1. y as is an ( IT) nia arti hai Sweate that the bottle contie 15 prente the future | reas what least turts in- als has take a , yram, matha ha 1. e- - peare, hai ralese Thala AM , Compranding Bar Saster print ) || TER , CAEM App - Mai Sud La Expected amala ay - Heal| Wwwwwww Sophom wwwhte CAPN What is the weet wat Expected hdd 2. What the con la base the docted! matedros y Centro fuper al We're XX . - - Edita, preto In the site What PWN Last pet wwwddd Priveler #dimated-wal ud mrm dak SH. We are Grupa Compare wewe Salve Tus ce In what is the fact that were B D E m F G von 2 3 Group Project 2 - Mini Case 1 4 Cost of Capital 5 6 7 During the last few years, Seaside Laboratories, a large invetsor-owned business, has been too constra 8 by the high cost of capital to make many capital investments. Recently, though, capital costs have been 9 and the company has decided to look seriously at a major expansion program that had been proposed 10 by the marketing department. Your group needs to assist Jessica Jones, the financial vice president. Y 11 task is to estimate Seaside's cost of capital. Jones has provided data that she believes is relevant to you 12 (1) The firm's tax rate is 21 percent. 13 (2) The current price of Seaside's 12 percent coupon, semiannual-payment, noncallable bonds with 15 14 years remaining to maturity is $1,153.72. Seaside does not use short-term interest-bearing debt on a 15 permanent basis. New bonds would be privately placed with no flotation costs. 16 (3) Seaside's common stock is currently selling at $50 per share (PO). Its last dividend (DO) was $3.12, 17 dividends are expected to grow at a constant rate of 5.8 percent in the foreseeable future. Seaside's beta 18 is 1.2, the yield on T-bonds is 5.6 percent, and the market risk premium is estimated to be 6 percent. For 19 debt-cost-plus-risk-premium approach, the firm uses a 3.2 percentage point risk premium. 20 (4) Seaside's target capital structure is 40 percent long-term debt and 60 percent common equity. 21 22 To help you structure the task, Jessica Jones has asked you to answer the following questions: 23 24 a. What is the market interest rate on Seaside's debt, and what is the component cost of this debt for 25 Corporate Cost of Capital (CCC) purposes? 26 27 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the Capital Asset Pricing M 28 what is Seaside's estimated cost of equity? 29 30 c. What is the estimated cost of equity using the discounted cash flow (DCF) approach? 31 32 d. What is the cost of equity based on the debt-cost-plus-risk-premium method? 33 34. What is your final estimate for the cost of equity? C G A B D E F H 09 36 . What is Seaside's CCC? 37 38 g. Seaside estimates that if it issues new common stock, the flotation cost will be 15 percent. Seaside 39 incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common 40 stock, taking into account the flotation costs? 41 42 I. Suppose Seaside issues 30-year debt with a par value of $1,000 and a coupon rate of 14 percent, paid annually. 43 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 44 45. What will be the CCC If Seaside issues the new common stock and the new debt, and keeps the same capital structure? 46 47. In general, whatare the factors that affect a CCC estimate? 48 49 Calculations 50 . What is the market interest rate on Seaside's debt, and what is the component cost of this debt for 51 Corporate Cost of Capital (CCC) purposes? 52 53 Bond maturity 54 Compounding period times per year 55 Coupon rate 56 Bond's par value 57 58 Number of periods (NPER) 59 Coupon payment (PMT) 60 Bond's present value (PV) 61 Bond's future value (FV) 62 Before-tax cost of debt 63 Tax rate 64 After-tax cost of debt 65 66 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the CAPM approach. 67 what is Seaside's estimated cost of equity? 68 years B D E F 64 After-tax cost of debt 65 66 b. For now, Seaside doesn't plan to issue new shares of common stock. Using the CAPM approach, 67 what is Seaside's estimated cost of equity? 68 69 Risk-free rate 70 Market risk premium 71 Beta 72 Estimated cost of equity 73 74 . What is the estimated cost of equity using the discounted cash flow (DCF) approach? 75 76 Stock current price 77 Last dividend payment 78 Expected growth rate 79 Next dividend payment 80 Estimated cost of equity 81 82 d. What is the cost of equity based on the debt-cost-plus-risk-premium method? 83 84 Risk Premium 85 Before-tax cost of debt 0.0% =C62 86 Estimated cost of equity 87 88 e. What is your final estimate for the cost of equity! 89 90 CAPM 0.0% =B72 91 Constant growth 0.0%=B80 92 Bond cost plus risk premium 0.0%B86 93 Final estimate of cost of equity 94 95 1. What is Seaside's corporate cost of capital (CCC)? 96 B F G A B C D E F G 88. What is your final estimate for the cost of equity? 89 90 CAPM 0.0%=B72 91 Constant growth 0.0%B80 92 Bond cost plus risk premium 0.0%B86 93 Final estimate of cost of equity 94 95 1. What is Seaside's corporate cost of capital (CCC)? 96 97 Wa E(Rd) 0.0% --C64 98 We E(Re) 0.044 -D93 99 100 101 g. Seaside estimates that if it issues new common stock, the flotation cost will be 15 percent. Seaside 102 incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common 103 stock, taking into account the flotation costs? 104 105 Price PO 106 Last dividend payment DO 107 Expected growth rate 108 Next dividend payment Di 109 Flotation costs 110 Price after flotation costs 111 Estimated cost of new stock 112 113 h. Suppose Seaside issues 30-year debt with a par value of $1.000 and a coupon rate of 14 percent, paid annually. 114 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 115 116 Number of periods Vears 117 Gross par value 118 Coupon rate 119 Coupon payment 120 Flotation costs GP2MC1 CDANAS E G A B C D E F H 709 Flotation costs 110 Price after flotation costs 111 Estimated cost of new stock 112 113 h. Suppose Seaside issues 30-year debt with a par value of $1,000 and a coupon rate of 14 percent, paid annually. 114 If flotation costs are 2 percent, what is the after-tax cost of debt for the new bond? 115 116 Number of periods years 117 Gross par value 118 Coupon rate 119 Coupon payment 120 Flotation costs 121 Net par value 122 Before-tax cost of debt 123 Tax rate 124 After-tax cost of debt 125 126 1. What will be the CCC if Seaside issues the new common stock and the new debt, and keeps the same capital structure? 127 128 E(Rd 0.00% -C124 129 W E(Re) 130 131 132). In general, what are the factors that affect a CCC estimate? (Narrative) 133 134 135 136 137 138 139 140 141 wa 0.0024 CI11 GP2MC1 GP2MC2 : Mal Culo Capital - a naray to date a ni hat a hair Ire Sentet e para, Jalan produselor in hendrer at is the prints platest =m - art is Sedes comprendre som er artists are protein y tatar arintain - Thaai praiseitte htt-sail-plant-ri pey (4 Shats is a parat team di nee inai, hara thaan kart attest pain are alageni ( Center , 1. y as is an ( IT) nia arti hai Sweate that the bottle contie 15 prente the future | reas what least turts in- als has take a , yram, matha ha 1. e- - peare, hai ralese Thala AM , Compranding Bar Saster print ) || TER , CAEM App - Mai Sud La Expected amala ay - Heal| Wwwwwww Sophom wwwhte CAPN What is the weet wat Expected hdd 2. What the con la base the docted! matedros y Centro fuper al We're XX . - - Edita, preto In the site What PWN Last pet wwwddd Priveler #dimated-wal ud mrm dak SH. We are Grupa Compare wewe Salve Tus ce In what is the fact that were

Step by Step Solution

There are 3 Steps involved in it

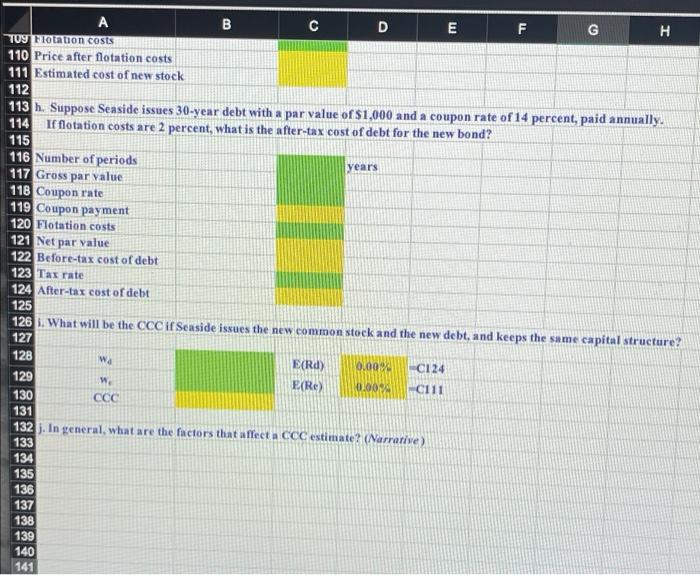

Get step-by-step solutions from verified subject matter experts