Question: a) Ganang Berhad is considering two mutually exclusive projects which required similar amount of initial investment. Both projects have 5-year life. The cost of capital

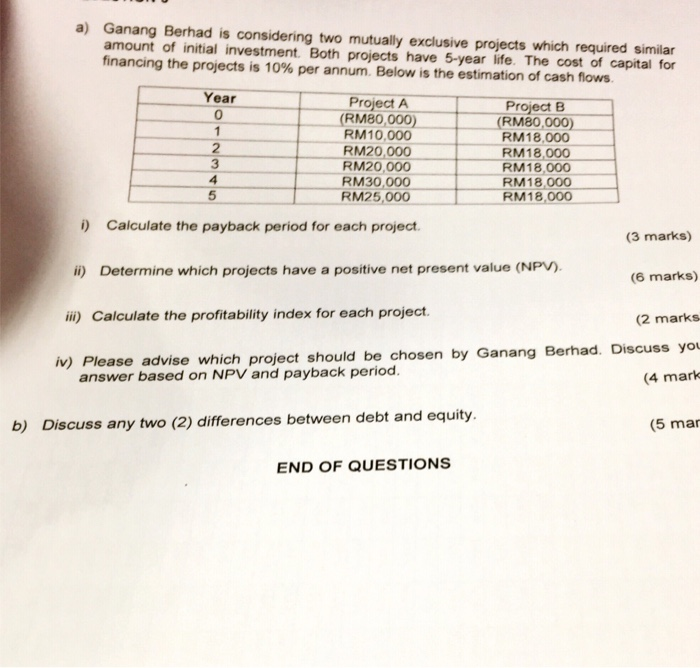

a) Ganang Berhad is considering two mutually exclusive projects which required similar amount of initial investment. Both projects have 5-year life. The cost of capital for financing the projects is 10% per annum. Below is the estimation of cash flows. Year Project A (RM80,000) RM10,000 RM20,000 RM20,000 RM30,000 RM25,000 Project B (RM80,000) RM18,000 1 2 3 RM18,000 RM18,000 RM18.000 RM18,000 4 5 ) Calculate the payback period for each project. (3 marks) ii) Determine which projects have a positive net present value (NPV) (6 marks) ii) Calculate the profitability index for each project. (2 marks iv) Please advise which project should be chosen by Ganang Berhad. Discuss you answer based on NPV and payback period. (4 mark Discuss any two (2) differences between debt and equity (5 mar b) END OF QUESTIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts