Question: A general partner: Multiple Choice faces double taxation whereas a limited partner does not. has a maximum loss equal to his or her equity investment

A general partner:

Multiple Choice

faces double taxation whereas a limited partner does not.

has a maximum loss equal to his or her equity investment in the partnership.

is responsible for percent of the firm's debts if he or she owns percent of the partnership.

receives a salary in lieu of a portion of the partnership's profits.

is personally responsible for percent of the debts of the partnership.

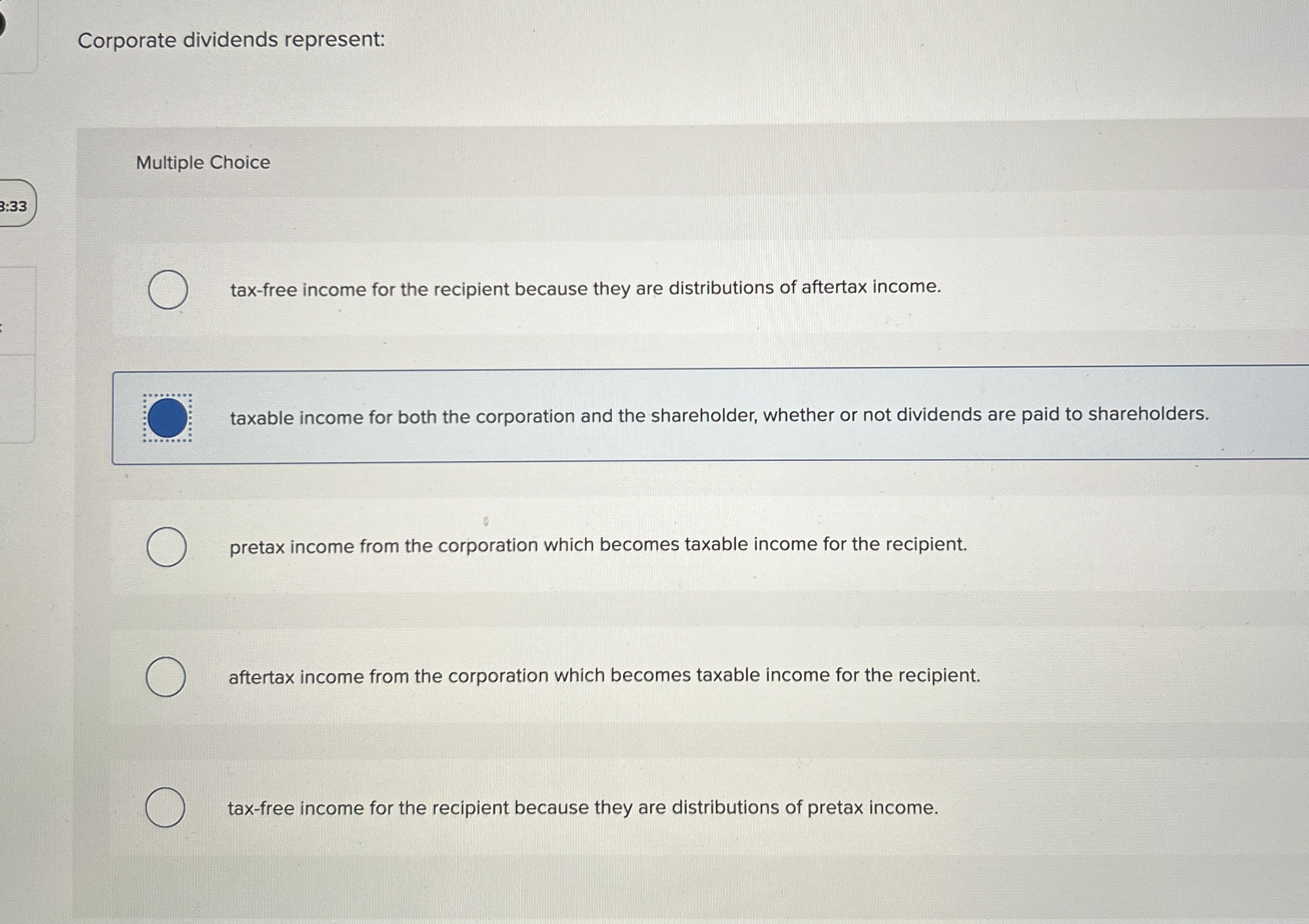

Corporate dividends represent:

Multiple Choice

:

taxfree income for the recipient because they are distributions of aftertax income.

taxable income for both the corporation and the shareholder, whether or not dividends are paid to shareholders.

pretax income from the corporation which becomes taxable income for the recipient.

aftertax income from the corporation which becomes taxable income for the recipient.

taxfree income for the recipient because they are distributions of pretax income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock