Question: please answer all questions or dont answer at all 12) A general partner: A) has less legal liability than a limited partner. B) can end

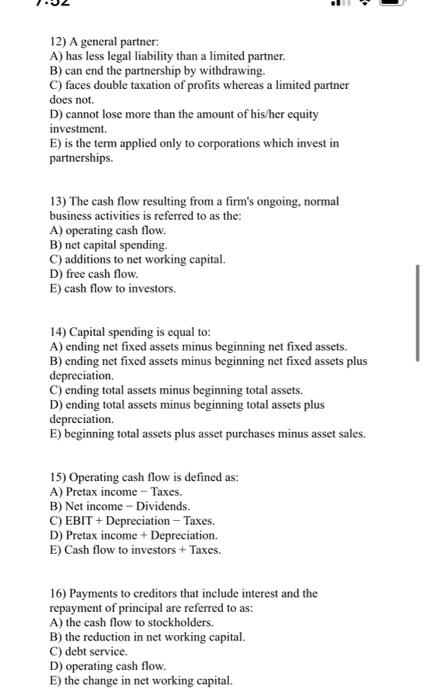

12) A general partner: A) has less legal liability than a limited partner. B) can end the partnership by withdrawing. C) faces double taxation of profits whereas a limited partner does not. D) cannot lose more than the amount of his/her equity investment. E) is the term applied only to corporations which invest in partnerships. 13) The cash flow resulting from a firm's ongoing, normal business activities is referred to as the: A) operating cash flow. B) net capital spending. C) additions to net working capital. D) free cash flow. E) cash flow to investors. 14) Capital spending is equal to: A) ending net fixed assets minus beginning net fixed assets. B) ending net fixed assets minus beginning net fixed assets plus depreciation. C) ending total assets minus beginning total assets. D) ending total assets minus beginning total assets plus depreciation. E) beginning total assets plus asset purchases minus asset sales. 15) Operating cash flow is defined as: A) Pretax income - Taxes. B) Net income - Dividends. C) EBIT+ Depreciation - Taxes. D) Pretax income + Depreciation. E) Cash flow to investors + Taxes. 16) Payments to creditors that include interest and the repayment of principal are referred to as: A) the cash flow to stockholders. B) the reduction in net working capital. C) debt service. D) operating cash flow. E) the change in net working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts