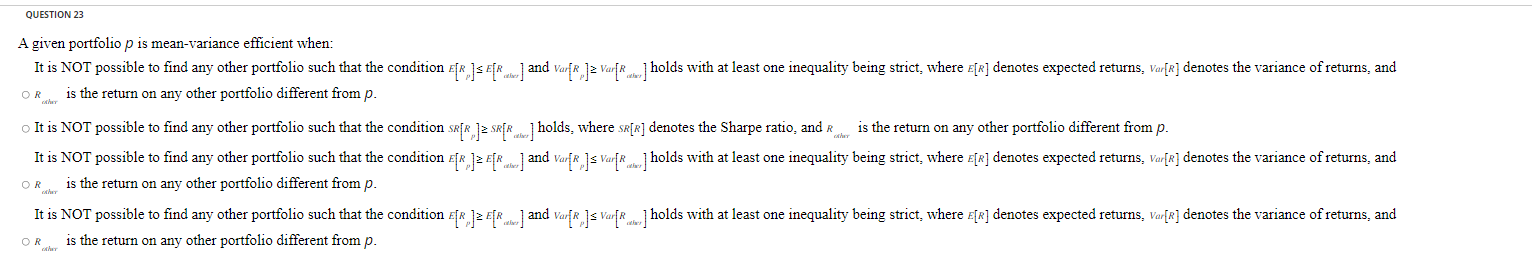

Question: A given portfolio p is mean-variance efficient when: is the return on any other portfolio different from p. It is NOT possible to find any

A given portfolio p is mean-variance efficient when: is the return on any other portfolio different from p. It is NOT possible to find any other portfolio such that the condition SR[Rp]SR[Ralse] holds, where SR[R] denotes the Sharpe ratio, and Rcair is the return on any other portfolio different from p. ORachro is the return on any other portfolio different from p. ORaxhr is the return on any other portfolio different from p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts