Question: Given the covariance matrix from weekly historical data and assuming a risk-free rate of 3%, describ e how you would invest in your stocks and

Given the covariance matrix from weekly historical data and assuming a risk-free rate of 3%, describe how you would invest in your stocks and a risk-free asset to get:

A. The minimum variance portfolio.

B. The mean-variance efficient portfolio (unconstrained).

C. The mean-variance efficient portfolio with no short selling and with maximum 50% margined positions. (This is effectively a constraint on the weights in each stock.)

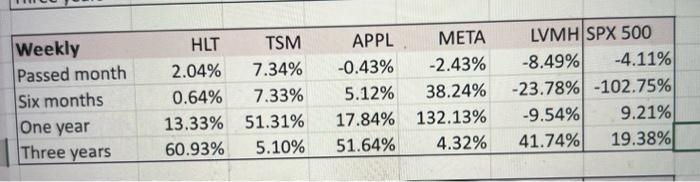

The return of each is given in the picture

\begin{tabular}{|c|c|c|c|c|c|c|} \hline Weekly & HLT & TSM & APPL & META & LVMH & SPX 500 \\ \hline Passed month & 2.04% & 7.34% & 0.43% & 2.43% & 8.49% & 4.11% \\ \hline Six months & 0.64% & 7.33% & 5.12% & 38.24% & 23.78% & 102.75% \\ \hline One year & 13.33% & 51.31% & 17.84% & 132.13% & 9.54% & 9.21% \\ \hline Three years & 60.93% & 5.10% & 51.64% & 4.32% & 41.74% & 19.38% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts