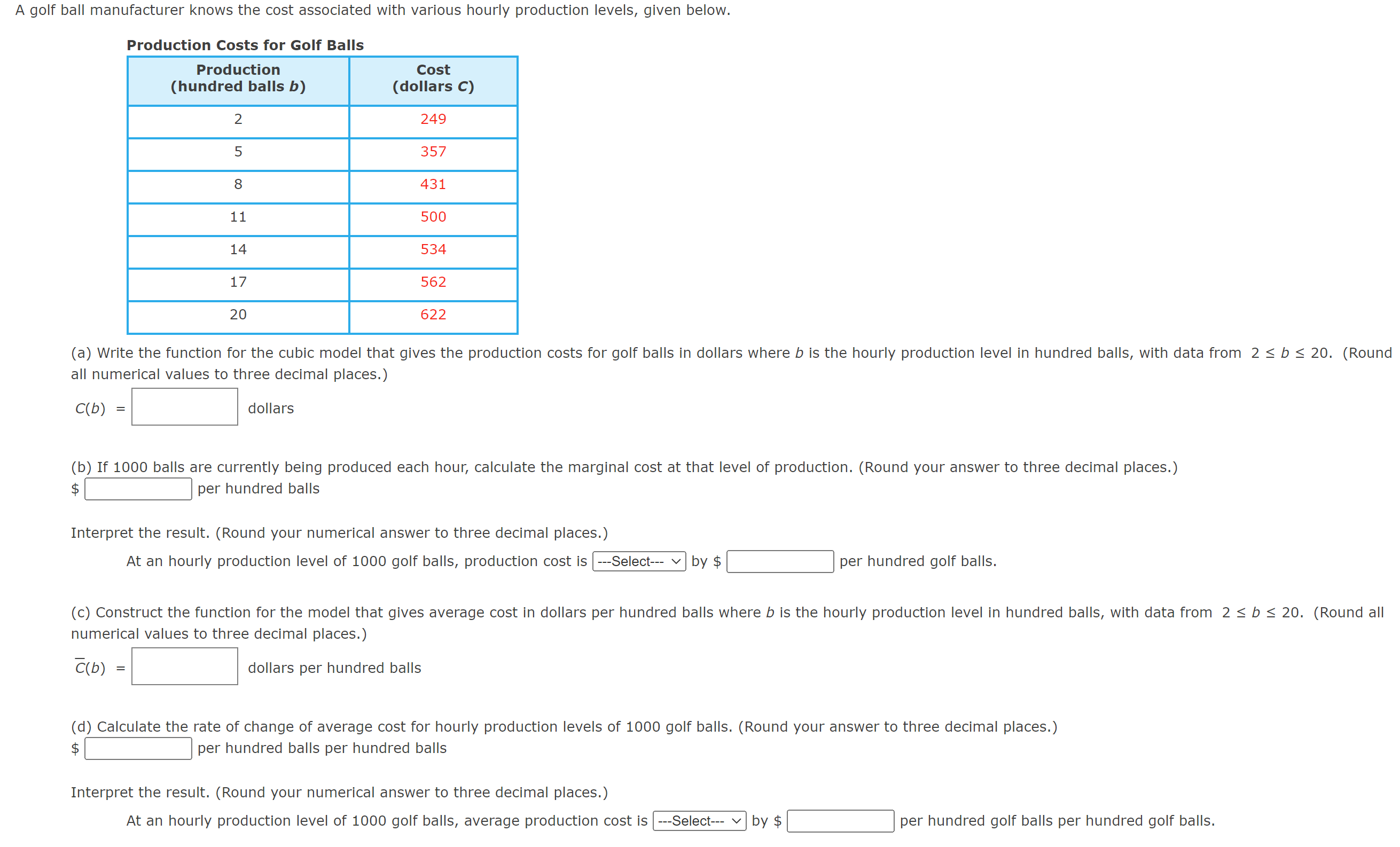

A golf ball manufacturer knows the cost associated with various hourly production levels, given below. Production...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

A golf ball manufacturer knows the cost associated with various hourly production levels, given below. Production Costs for Golf Balls Production (hundred balls b) 2 5 C(b) 8 = 11 14 17 20 Cost (dollars C) 249 357 431 dollars 500 534 (a) Write the function for the cubic model that gives the production costs for golf balls in dollars where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) C(b) 562 622 (b) If 1000 balls are currently being produced each hour, calculate the marginal ost at that level of production. (Round your answer per hundred balls $ Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, production cost is ---Select--- by $ (c) Construct the function for the model that gives average cost in dollars per hundred balls where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) dollars per hundred balls per hundred golf balls. three decimal places.) Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, average production cost is ---Select--- by $ (d) Calculate the rate of change of average cost for hourly production levels of 1000 golf balls. (Round your answer to three decimal places.) $ per hundred balls per hundred balls per hundred golf balls per hundred golf balls. A golf ball manufacturer knows the cost associated with various hourly production levels, given below. Production Costs for Golf Balls Production (hundred balls b) 2 5 C(b) 8 = 11 14 17 20 Cost (dollars C) 249 357 431 dollars 500 534 (a) Write the function for the cubic model that gives the production costs for golf balls in dollars where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) C(b) 562 622 (b) If 1000 balls are currently being produced each hour, calculate the marginal ost at that level of production. (Round your answer per hundred balls $ Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, production cost is ---Select--- by $ (c) Construct the function for the model that gives average cost in dollars per hundred balls where b is the hourly production level in hundred balls, with data from 2 b 20. (Round all numerical values to three decimal places.) dollars per hundred balls per hundred golf balls. three decimal places.) Interpret the result. (Round your numerical answer to three decimal places.) At an hourly production level of 1000 golf balls, average production cost is ---Select--- by $ (d) Calculate the rate of change of average cost for hourly production levels of 1000 golf balls. (Round your answer to three decimal places.) $ per hundred balls per hundred balls per hundred golf balls per hundred golf balls.

Expert Answer:

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these mathematics questions

-

Describe how business models for stakeholders in the health industry are (or are not) built for optimized patient outcome?

-

Give parametric equations and parameter intervals for the motion of a particle in the xy-plane. Identify the particles path by finding a Cartesian equation for it. Graph the Cartesian equation....

-

Go to www.pearsonhighered.com/ sullivanstats to obtain the data file SullivanStatsSurveyII using the file format of your choice for the version of the text you are using. One question asked in this...

-

1. One of the elements on a financial statement is comprehensive income. Comprehensive income excludes changes in equity resulting from which of the following? (a) Loss from discontinued operations...

-

You are in a meeting to decide on a new product development investment. The VP in charge of the meeting seems to be asking a lot of questions of the design engineers. And it also seems like the VP...

-

This problem continues the Davis Consulting situation from Problem P2-43. You will need to use the unadjusted trial balance and posted T-accounts that you prepared in Problem P2- 43. The unadjusted...

-

Image transcription text 156 197 E 122 196 1. ROW DHCRAN REPRESENTS ONE () POWER 124 125 116 CTC'S. TWO (2) MRSC'S. AND ONE (1) STC. 150 137 OPERATION NOT SHOW . TO DUCT BURNER (121 189 UP DRUM...

-

The aggregate investment function (30 Marks) Understanding investment behavior is important to understanding the cyclical behavior of the economy. Here we start with a simple production function,...

-

The Larisa Company is exiting bankruptcy reorganization with the following account balances: Receivables Inventory Buildings Liabilities Common stock Additional paid-in capital Retained earnings...

-

Given the data table below answer the questions. Data table Pillows.com Sales Budget: Type of Sale For the Quarter Ended March 31 Type of Sale: January February March 1st Quarter Cash sales (10%)...

-

On a patient in assist control what setting controls how easily the machine can be cycled?

-

A city employee is tasked with taking, recording and depositing payments from citizens for parking tickets. Instead, the employee takes the cash payments for themself and deletes the parking tickets...

-

When a transaction is entered in the general journal, which account is always recorded first in the Description column?

-

Project managers may also face legal issues following specific procedures during the project. Critically assess the importance of legal considerations for project managers.

-

Beginning with a country that has a trade deficit, demonstrate graphically what will happen to a countrys potential output with globalization if that countrys costs of production fall. Explain your...

-

Skyler is covered by his company's health insurance plan. The health insurance costs his company $3,500 a year. During the year, Skyler is diagnosed with a serious illness and the health insurance...

-

Matthew borrows $250,000 to invest in bonds. During 2012, his interest on the loan is $30,000. Matthew's interest income from the bonds is $10,000. This is Matthew's only investment income. a....

-

Mallory Corporation has a calendar year-end. The corporation has paid estimated payments of $10,000 during 2012 but still owes an additional $5,000 for its 2012 tax year. a. When is the 2012 tax...

-

From the following trial balance of G. Foot after his first year's trading, you are required to draw up a statement of profit or loss for the year ending 30 June 2016. A statement of financial...

-

At the beginning of the financial year on 1 April 2017, a company had a balance on plant account of 372,000 and on provision for depreciation of plant account of 205,400. The company's policy is to...

-

(a) Distinguish between capital and revenue expenditure. (b) Drake Ltd took delivery of a computer network on 1 July 2016, the beginning of its financial year. The list price of the equipment was...

Study smarter with the SolutionInn App