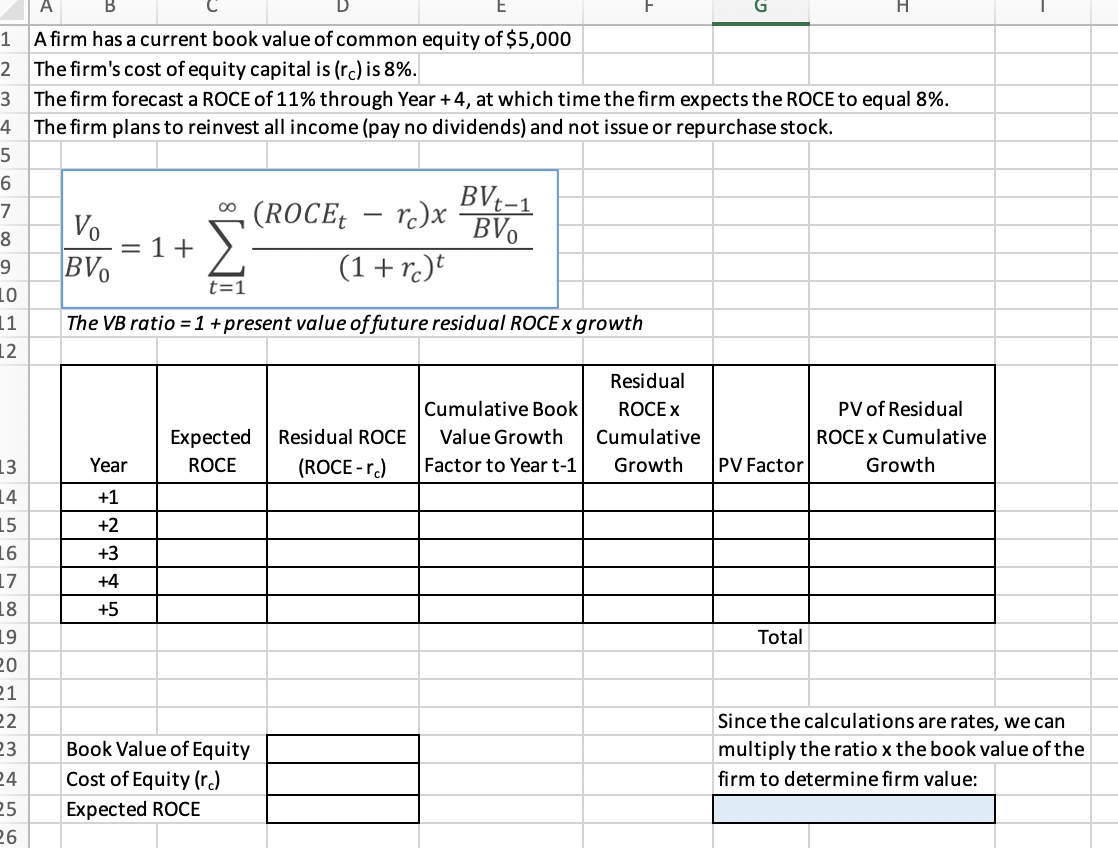

Question: A H 1 A firm has a current book value of common equity of $5,000 The firm's cost of equity capital is (rc) is 8%.

A H 1 A firm has a current book value of common equity of $5,000 The firm's cost of equity capital is (rc) is 8%. The firm forecast a ROCE of 11% through Year +4, at which time the firm expects the ROCE to equal 8%. The firm plans to reinvest all income (pay no dividends) and not issue or repurchase stock. 2 3 4 5 6 7 8 9 LO 11 12 00 - V. = 1 + BV. BVt-1 (ROCEE - rox BV. (1 + r)t t=1 The VB ratio = 1 + present value of future residual ROCE x growth Residual ROCEX Cumulative Growth Expected ROCE Cumulative Book Value Growth Factor to Year t-1 Residual ROCE (ROCE-ra) PV of Residual ROCEx Cumulative Growth Year PV Factor +1 +2 +3 +4 +5 W NO 500 W 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Total Book Value of Equity Cost of Equity (rc) Expected ROCE Since the calculations are rates, we can multiply the ratio x the book value of the firm to determine firm value: A H 1 A firm has a current book value of common equity of $5,000 The firm's cost of equity capital is (rc) is 8%. The firm forecast a ROCE of 11% through Year +4, at which time the firm expects the ROCE to equal 8%. The firm plans to reinvest all income (pay no dividends) and not issue or repurchase stock. 2 3 4 5 6 7 8 9 LO 11 12 00 - V. = 1 + BV. BVt-1 (ROCEE - rox BV. (1 + r)t t=1 The VB ratio = 1 + present value of future residual ROCE x growth Residual ROCEX Cumulative Growth Expected ROCE Cumulative Book Value Growth Factor to Year t-1 Residual ROCE (ROCE-ra) PV of Residual ROCEx Cumulative Growth Year PV Factor +1 +2 +3 +4 +5 W NO 500 W 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Total Book Value of Equity Cost of Equity (rc) Expected ROCE Since the calculations are rates, we can multiply the ratio x the book value of the firm to determine firm value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts