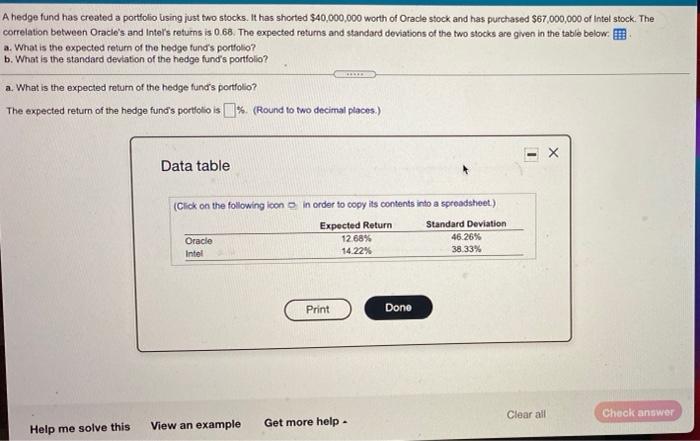

Question: A hedge fund has created a portfolio Using just two stocks. It has shorted $40,000,000 worth of Orade stock and has purchased $67,000,000 of Intel

A hedge fund has created a portfolio Using just two stocks. It has shorted $40,000,000 worth of Orade stock and has purchased $67,000,000 of Intel stock. The correlation between Oracle's and Intel's returns is 0.68. The expected returns and standard deviations of the two stocks are given in the table below a. What is the expected return of the hedge fund's portfolio? b. What is the standard deviation of the hedge fund's portfolio? a What is the expected return of the hedge fund's portfolio? The expected return of the hedge fund's portfolio is % (Round to two decimal places.) - X Data table (Click on the following icon in order to copy its contents into a spreadsheet) Oracle Intel Expected Return 12.68% 14.22% Standard Deviation 46.26% 38.33% Print Done Clear all Check answer Help me solve this View an example Get more help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts