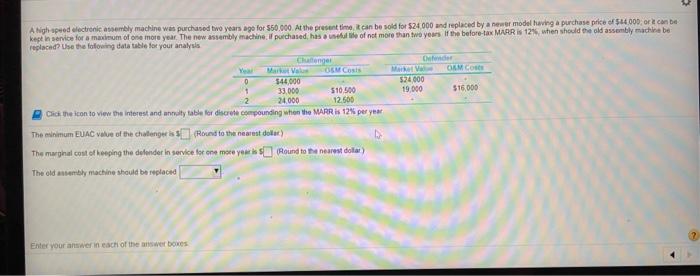

Question: A high speed electronic assembly machine was purchased two years ago for $50.000. At the present time it can be sold for $24,000 and replaced

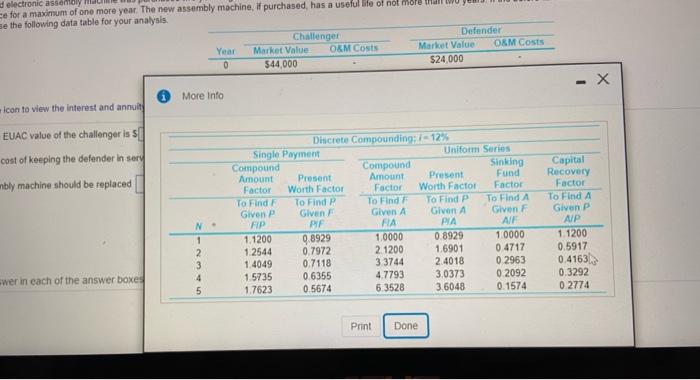

A high speed electronic assembly machine was purchased two years ago for $50.000. At the present time it can be sold for $24,000 and replaced by a newer modellaving a purchase price of $44.000 or can be kept in nice for a madom of one more year. The new assembly machine purchased, has all of not more than two years of the before tax MARRIS 12% when should the old assembly machine be replaced? Use the following datatable for your analysis Curtonger Mark V OEM Costs Mar OKM COS 0 544,000 574000 33.000 510.500 19.000 516,000 24.000 12.500 Click the icon to view the interest and annaty table for discrete compounding when the MARR is 12% per year 1 2 The minimum EUAC value of the challenge is Rond to the nearest do) The marginal cost of keeping the defender in service for one more you s Round to the nearest dolar) The old assembly machine should be replaced Enter your answer in each of the answer boxes d electronic assembly se for a maximum of one more year. The new assembly machine, I purchased, has a useful le of not more than se the following data table for your analysis Challenger Defender Market Value O&M Costs Market Value O&M Costs 0 544,000 $24,000 Year X More Info icon to view the interest and annut EUAC value of the challenger is si cost of keeping the defender in sery Capital Recovery mbly machine should be replaced Factor Discrete Compounding;/ -12 Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find To Find P To Find To Find P To Find A Given P Glven Given A Given A Given F FIP RI FIA PA All 1.1200 0.8929 1.0000 0.8929 10000 12544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3 3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6:3528 3.6048 0.1574 To Find A Given P AIP N 1 2 3 1.1200 0.5917 0.41633 0.3292 02774 wwer in each of the answer boxes 4 5 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts