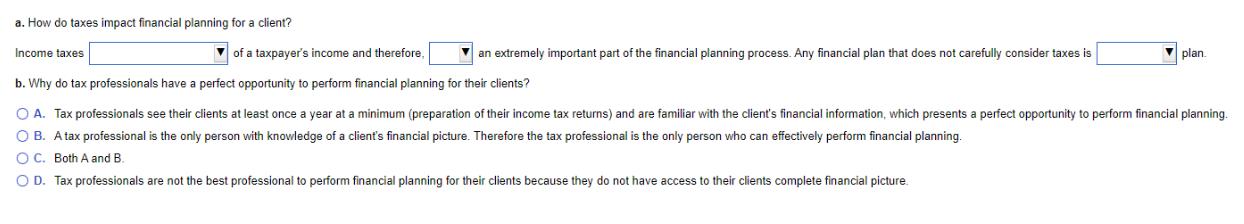

Question: a. How do taxes impact financial planning for a client? Income taxes of a taxpayer's income and therefore, an extremely important part of the

a. How do taxes impact financial planning for a client? Income taxes of a taxpayer's income and therefore, an extremely important part of the financial planning process. Any financial plan that does not carefully consider taxes is b. Why do tax professionals have perfect opportunity to perform financial planning for their clients? O A. Tax professionals see their clients at least once a year at a minimum (preparation of their income tax returns) and are familiar with the client's financial information, which presents a perfect opportunity to perform financial planning. O B. A tax professional is the only person with knowledge of a client's financial picture. Therefore the tax professional is the only person who can effectively perform financial planning. OC. Both A and B. O D. Tax professionals are not the best professional to perform financial planning for their clients because they do not have access to their clients complete financial picture. plan.

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below C Both A and B ... View full answer

Get step-by-step solutions from verified subject matter experts