Question: a) How many shares does Gotham Pension get? b) How many shares does Clark Kent get? c) How many shares does City Central get? d)

a) How many shares does Gotham Pension get?

b) How many shares does Clark Kent get?

c) How many shares does City Central get?

d) How many shares does Arthur Curry get?

e) How many shares does Barry Allen get?

f) What is the total cash flow to Wayne after the sale?

g) What is the total cash flow to Berkman Investment Bank after the sale?

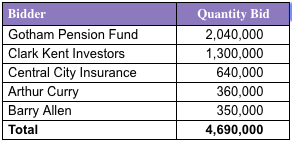

Issuing securities. Bruce Wayne is going public with his new business. Berkman Investment Bank will be his banker and is doing a best efforts sale with a 4.5% commission fee. The SEC has authorized Wayne 5,150,000 shares for this issue. He plans to keep 990,000 shares for himself, hold back an additional 150,000 shares according to the green-shoe provision for Berkman Investment Bank, pay off Venture Capitalists with 490,000 shares, and sell the remaining shares at $16.63 a share. Given the bids at the auction (shown on the table here: EEB), distribute the shares to all bidders using a pro-rata share procedure, and assume Berkma after the sale? To Berkman Investment Bank? n Investment Bank takes its green-shoe shares. What is the total cash flow to Wayne Quantity Bid 2,040,000 1,300,000 640,000 360,000 350,000 4,690,000 Bidder Gotham Pension Fund Clark Kent Investors Central City Insurance Arthur Curry Barry Allen Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts