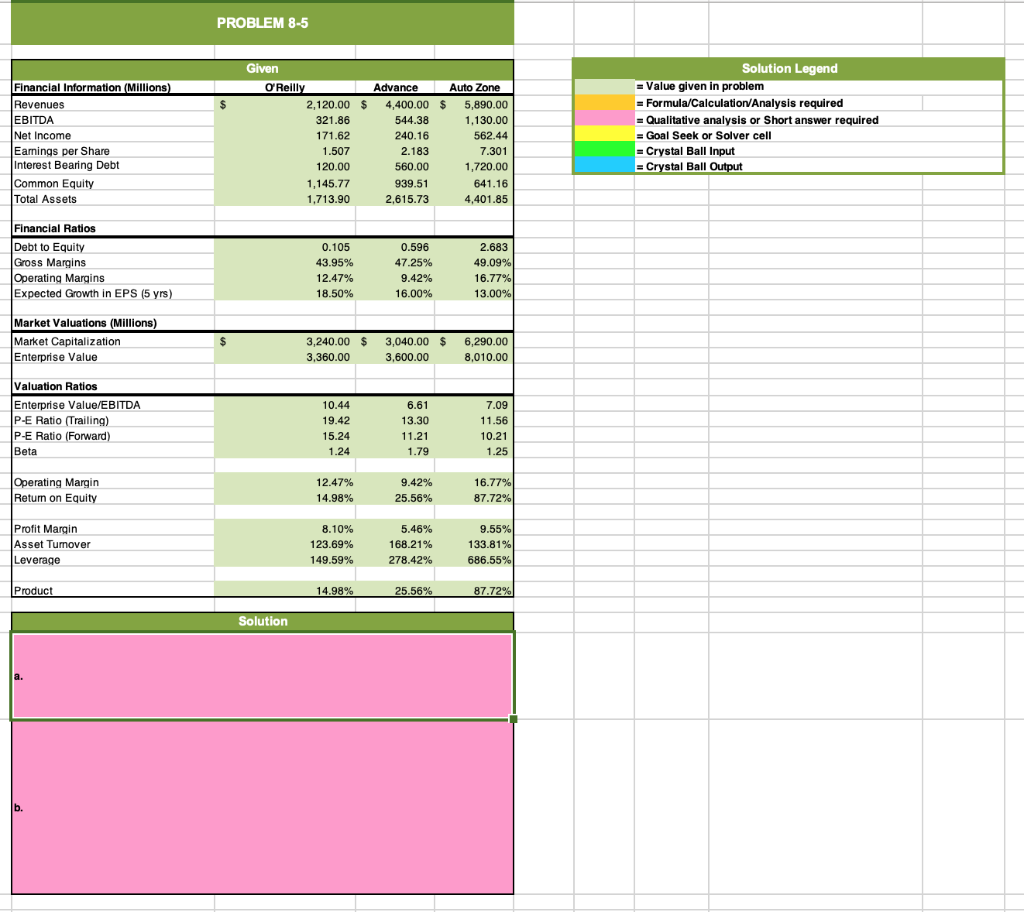

Question: a. How would you use this information to evaluate a potential offer to acquire Carquests equity? b. What do you think is driving the rather

a. How would you use this information to evaluate a potential offer to acquire Carquests equity?

b. What do you think is driving the rather dramatic differences in ratios of the three firms?

PROBLEM 8-5 Given Solution Legend Value given in problem Financial Information (Millions Revenues EBITDA Net Income Earnings per Share Interest Bearing Debt Common Equity Total Assets O'Reill Advance Auto Zone Formula/Calculation/Analysis required 2,120.00 $ 4,400.00 $ 5,890.00 1,130.00 562.44 7.301 1,720.00 641.16 4,401.85 321.86 171.62 1.507 120.00 1,145.77 1,713.90 544.38 240.16 2.183 560.00 939.51 2,615.73 Qualitative analysis or Short answer required Goal Seek or Solver cell Crystal Ball Input Crystal Ball Financial Ratios Debt to Equity Gross Margins Operating Margins Expected Growth in EPS (5 yrs) 0.105 43.95% 12.47% 18.50% 0.596 47.25% 9.42% 16.00% 2.683 49.09% 16.77% 13.00% Market Valuations (Millions) Market Capitalization Enterprise Value 3,240.00 $ 3,040.00 $ 6,290.00 3,600.00 3,360.00 8,010.00 Valuation Ratios Enterprise Value EBITDA P-E Ratio (Trailing) P-E Ratio (Forward) Beta 10.44 19.42 15.24 1.24 6.61 13.30 11.21 11.56 10.21 1.25 Operating Margin Return on Equity 12.47% 14.98% 16.77% 87.72% 9.42% 25.56% Profit Margin Asset Tumover Leverage 8.10% 123.69% 149.59% 5.46% 168.21% 278.42% 9.55% 133.81% 686.55% Product Solution a. b. PROBLEM 8-5 Given Solution Legend Value given in problem Financial Information (Millions Revenues EBITDA Net Income Earnings per Share Interest Bearing Debt Common Equity Total Assets O'Reill Advance Auto Zone Formula/Calculation/Analysis required 2,120.00 $ 4,400.00 $ 5,890.00 1,130.00 562.44 7.301 1,720.00 641.16 4,401.85 321.86 171.62 1.507 120.00 1,145.77 1,713.90 544.38 240.16 2.183 560.00 939.51 2,615.73 Qualitative analysis or Short answer required Goal Seek or Solver cell Crystal Ball Input Crystal Ball Financial Ratios Debt to Equity Gross Margins Operating Margins Expected Growth in EPS (5 yrs) 0.105 43.95% 12.47% 18.50% 0.596 47.25% 9.42% 16.00% 2.683 49.09% 16.77% 13.00% Market Valuations (Millions) Market Capitalization Enterprise Value 3,240.00 $ 3,040.00 $ 6,290.00 3,600.00 3,360.00 8,010.00 Valuation Ratios Enterprise Value EBITDA P-E Ratio (Trailing) P-E Ratio (Forward) Beta 10.44 19.42 15.24 1.24 6.61 13.30 11.21 11.56 10.21 1.25 Operating Margin Return on Equity 12.47% 14.98% 16.77% 87.72% 9.42% 25.56% Profit Margin Asset Tumover Leverage 8.10% 123.69% 149.59% 5.46% 168.21% 278.42% 9.55% 133.81% 686.55% Product Solution a. b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts