Question: (a) I. Explain the term Partnership and state two (2) reasons for partnership 13 marks! II. List any four (4) things that apply according to

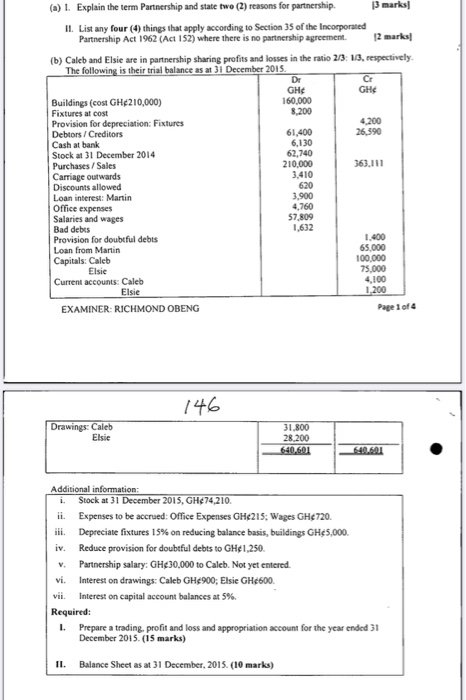

(a) I. Explain the term Partnership and state two (2) reasons for partnership 13 marks! II. List any four (4) things that apply according to Section 35 of the Incorporated Partnership Act 1962 (Act 152) where there is no partnership agreement 12 marks! (b) Caleb and Elsie are in partnership sharing profits and losses in the ratio 2/3:13, respectively The following is their trial balance as at 31 December 2015 Dr Cr GHE GHS Buildings (cost GH210,000) 160.000 Fixtures at cost 8,200 Provision for depreciation: Fixtures 4.200 Debtors / Creditors 61,400 26,590 Cash at bank 6,130 Stock at 31 December 2014 62,740 Purchases/Sales 210,000 363.111 Carriage outwards 3.410 Discounts allowed 620 Loan interest: Martin 3,900 Office expenses 4,760 Salaries and wages 57.809 Bad debts 1,632 Provision for doubtful debts 1.400 Loan from Martin 65,000 Capitals: Caleb 100.000 Elsie 75,000 Current accounts: Caleb 4,100 Elsie 1.200 EXAMINER: RICHMOND OBENG Page 1 of 146 Drawings: Caleb Elsie 31.800 28.200 640.601 640.601 Additional information: i. Stock at 31 December 2015, GH474,210. ii. Expenses to be accrued: Office Expenses GH215: Wages GH720. iii. Depreciate fixtures 15% on reducing balance basis, buildings GH$5,000. iv. Reduce provision for doubtful debts to GH1,250. v. Partnership salary: GH30,000 to Caleb. Not yet entered vi. Interest on drawings: Caleb GH4900; Elsie GH600. Interest on capital account balances at 5%. Required: Prepare a trading profit and loss and appropriation account for the year ended 31 December 2015. (15 marks) 1 II. Balance Sheet as at 31 December, 2015. (10 marks) (a) I. Explain the term Partnership and state two (2) reasons for partnership 13 marks! II. List any four (4) things that apply according to Section 35 of the Incorporated Partnership Act 1962 (Act 152) where there is no partnership agreement 12 marks! (b) Caleb and Elsie are in partnership sharing profits and losses in the ratio 2/3:13, respectively The following is their trial balance as at 31 December 2015 Dr Cr GHE GHS Buildings (cost GH210,000) 160.000 Fixtures at cost 8,200 Provision for depreciation: Fixtures 4.200 Debtors / Creditors 61,400 26,590 Cash at bank 6,130 Stock at 31 December 2014 62,740 Purchases/Sales 210,000 363.111 Carriage outwards 3.410 Discounts allowed 620 Loan interest: Martin 3,900 Office expenses 4,760 Salaries and wages 57.809 Bad debts 1,632 Provision for doubtful debts 1.400 Loan from Martin 65,000 Capitals: Caleb 100.000 Elsie 75,000 Current accounts: Caleb 4,100 Elsie 1.200 EXAMINER: RICHMOND OBENG Page 1 of 146 Drawings: Caleb Elsie 31.800 28.200 640.601 640.601 Additional information: i. Stock at 31 December 2015, GH474,210. ii. Expenses to be accrued: Office Expenses GH215: Wages GH720. iii. Depreciate fixtures 15% on reducing balance basis, buildings GH$5,000. iv. Reduce provision for doubtful debts to GH1,250. v. Partnership salary: GH30,000 to Caleb. Not yet entered vi. Interest on drawings: Caleb GH4900; Elsie GH600. Interest on capital account balances at 5%. Required: Prepare a trading profit and loss and appropriation account for the year ended 31 December 2015. (15 marks) 1 II. Balance Sheet as at 31 December, 2015. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts