Question: a) Identify two salient trends that can be inferred from Panel A. b) Give a reason the trends you identified may have occurred c) According

a) Identify two salient trends that can be inferred from Panel A. b) Give a reason the trends you identified may have occurred c) According to panel B, what are the most popular capital budgeting techniques used?

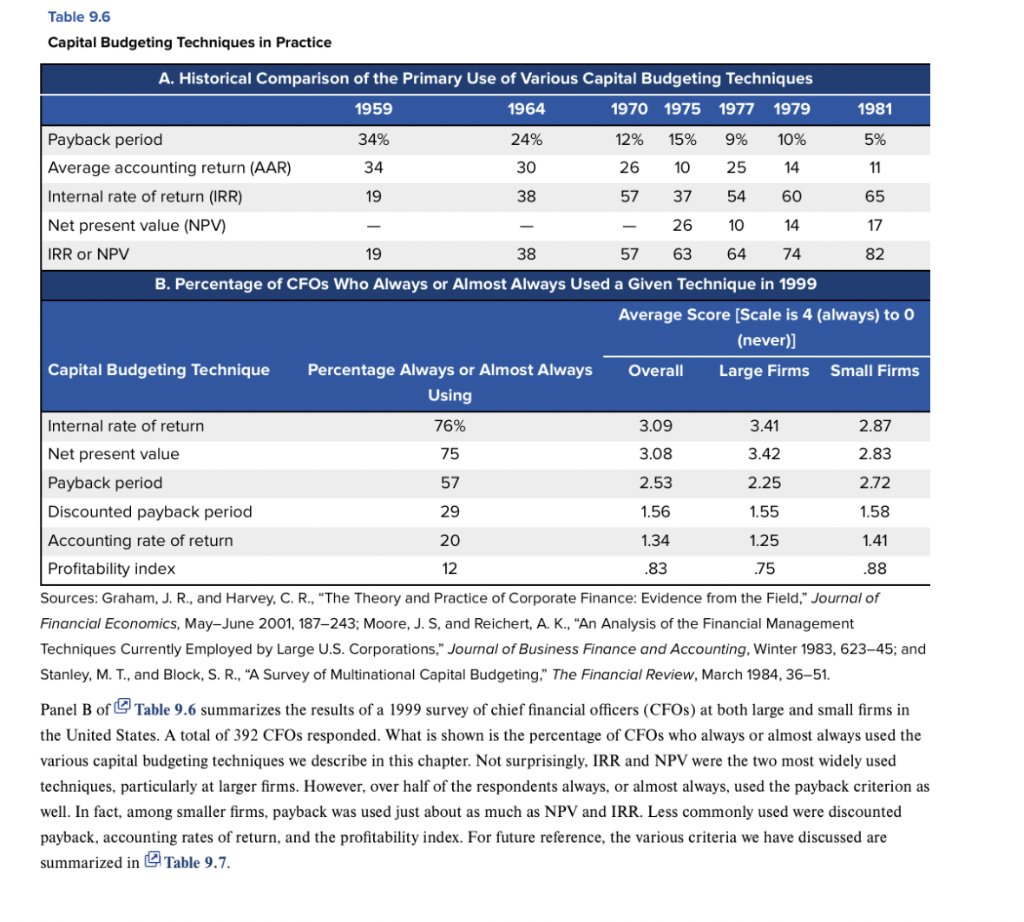

Table 9.6 Capital Budgeting Techniques in Practice Financial Economics, May-June 2001, 187243; Moore, J. S, and Reichert, A. K., "An Analysis of the Financial Management Techniques Currently Employed by Large U.S. Corporations," Journal of Business Finance and Accounting. Winter 1983, 623-45; and Stanley, M. T., and Block, S. R., "A Survey of Multinational Capital Budgeting," The Financial Review, March 1984, 36-51. Panel B of Table 9.6 summarizes the results of a 1999 survey of chief financial officers (CFOs) at both large and small firms in the United States. A total of 392 CFOs responded. What is shown is the percentage of CFOs who always or almost always used the various capital budgeting techniques we describe in this chapter. Not surprisingly, IRR and NPV were the two most widely used techniques, particularly at larger firms. However, over half of the respondents always, or almost always, used the payback criterion as well. In fact, among smaller firms, payback was used just about as much as NPV and IRR. Less commonly used were discounted payback, accounting rates of return, and the profitability index. For future reference, the various criteria we have discussed are summarized in Table 9.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts