Question: A* If the answer is too long just type refer to pdf The table below shows the values for 1-year European call and put

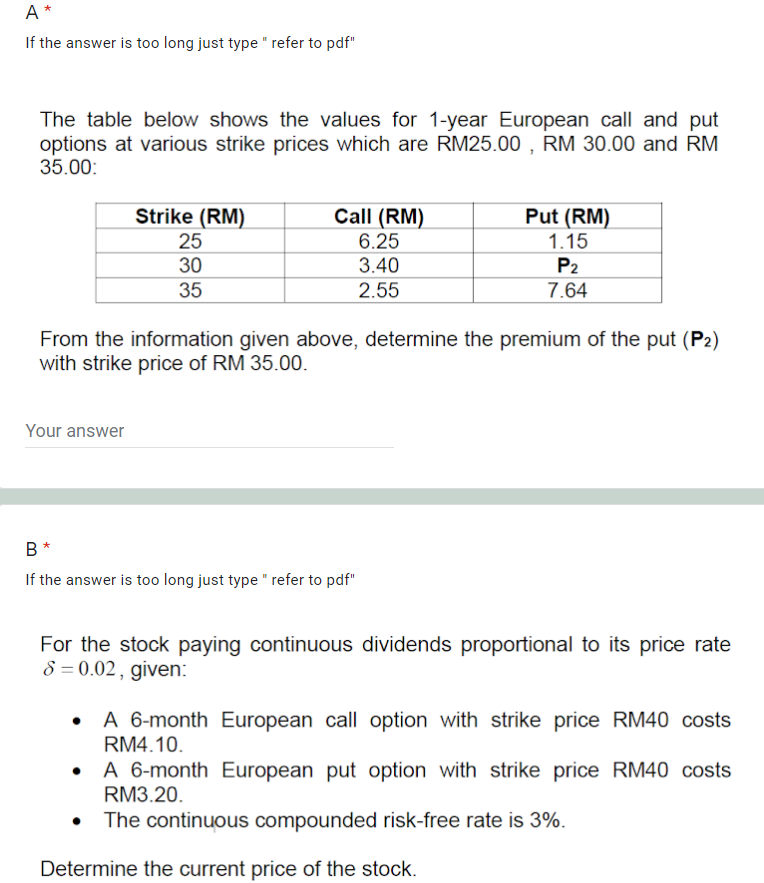

A* If the answer is too long just type " refer to pdf" The table below shows the values for 1-year European call and put options at various strike prices which are RM25.00 , RM 30.00 and RM 35.00: Strike (RM) 25 30 35 Call (RM) 6.25 3.40 2.55 Put (RM) 1.15 P2 7.64 From the information given above, determine the premium of the put (P2) with strike price of RM 35.00. Your answer B* If the answer is too long just type "refer to pdf" For the stock paying continuous dividends proportional to its price rate 8=0.02, given: A 6-month European call option with strike price RM40 costs RM4.10. A 6-month European put option with strike price RM40 costs RM3.20. The continuous compounded risk-free rate is 3%. Determine the current price of the stock. A* If the answer is too long just type " refer to pdf" The table below shows the values for 1-year European call and put options at various strike prices which are RM25.00 , RM 30.00 and RM 35.00: Strike (RM) 25 30 35 Call (RM) 6.25 3.40 2.55 Put (RM) 1.15 P2 7.64 From the information given above, determine the premium of the put (P2) with strike price of RM 35.00. Your answer B* If the answer is too long just type "refer to pdf" For the stock paying continuous dividends proportional to its price rate 8=0.02, given: A 6-month European call option with strike price RM40 costs RM4.10. A 6-month European put option with strike price RM40 costs RM3.20. The continuous compounded risk-free rate is 3%. Determine the current price of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts