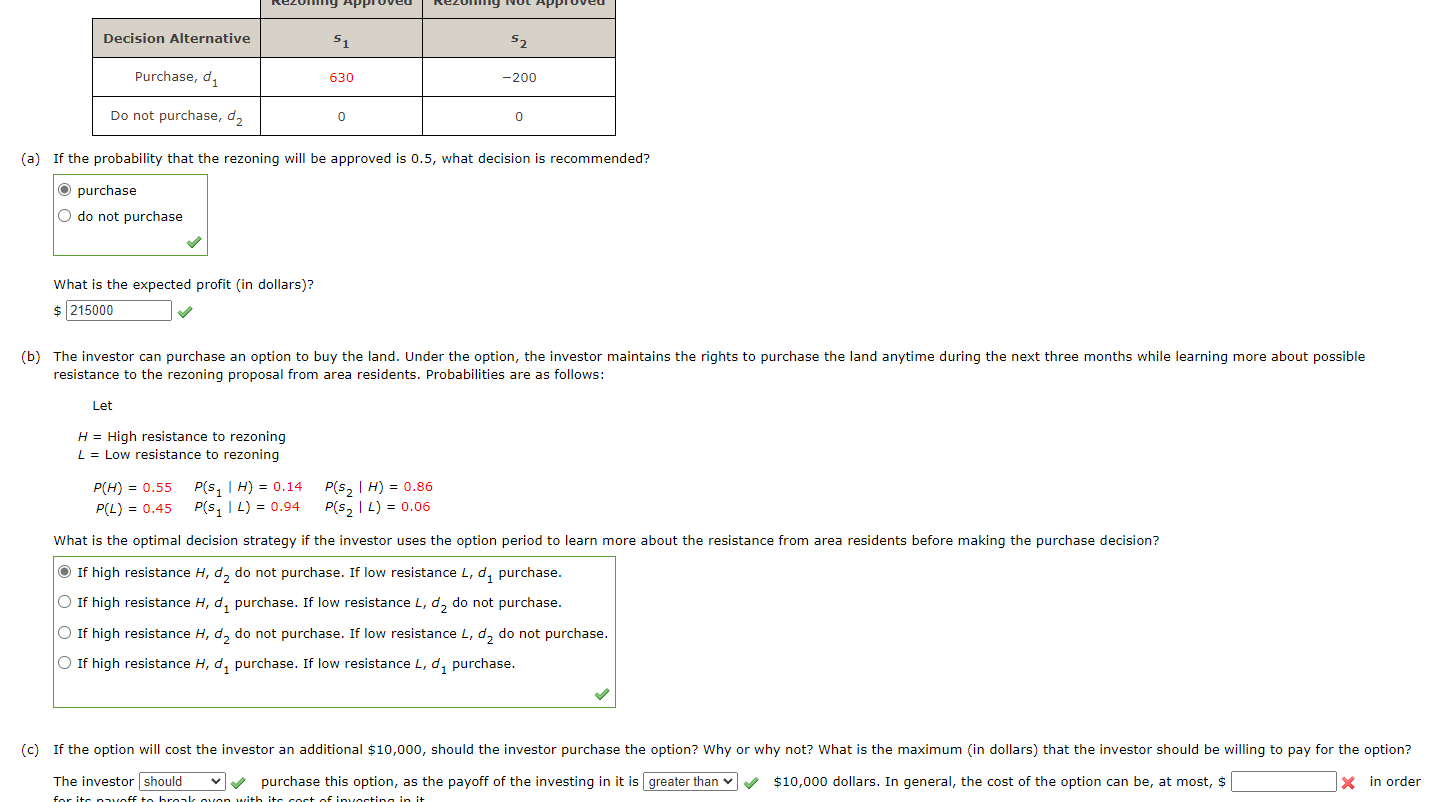

Question: (a) If the probability that the rezoning will be approved is 0.5, what decision is recommended? purchase do not purchase What is the expected profit

(a) If the probability that the rezoning will be approved is 0.5, what decision is recommended? purchase do not purchase What is the expected profit (in dollars)? $ resistance to the rezoning proposal from area residents. Probabilities are as follows: Let H= High resistance to rezoning L= Low resistance to rezoning P(H)=0.55P(L)=0.45P(s1H)=0.14P(s1L)=0.94P(s2H)=0.86P(s2L)=0.06 What is the optimal decision strategy if the investor uses the option period to learn more about the resistance from area residents before masing If high resistance H1d2 do not purchase. If low resistance L1d1 purchase. If high resistance H,d1 purchase. If low resistance L,d2 do not purchase. If high resistance H1d2 do not purchase. If low resistance L,d2 do not purchase. If high resistance H,d1 purchase. If low resistance L,d1 purchase. The investor purchase this option, as the payoff of the investing in it is $10,000 dollars. In general, the cost of the option can be, at most, $ W in ord (a) If the probability that the rezoning will be approved is 0.5, what decision is recommended? purchase do not purchase What is the expected profit (in dollars)? $ resistance to the rezoning proposal from area residents. Probabilities are as follows: Let H= High resistance to rezoning L= Low resistance to rezoning P(H)=0.55P(L)=0.45P(s1H)=0.14P(s1L)=0.94P(s2H)=0.86P(s2L)=0.06 What is the optimal decision strategy if the investor uses the option period to learn more about the resistance from area residents before masing If high resistance H1d2 do not purchase. If low resistance L1d1 purchase. If high resistance H,d1 purchase. If low resistance L,d2 do not purchase. If high resistance H1d2 do not purchase. If low resistance L,d2 do not purchase. If high resistance H,d1 purchase. If low resistance L,d1 purchase. The investor purchase this option, as the payoff of the investing in it is $10,000 dollars. In general, the cost of the option can be, at most, $ W in ord

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts