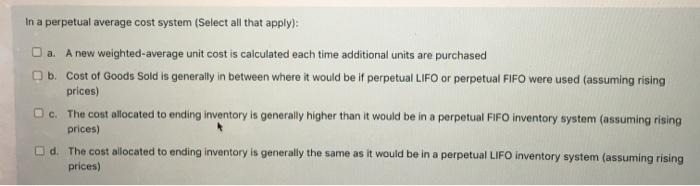

Question: a. In a perpetual average cost system (Select all that apply): a. A new weighted-average unit cost is calculated each time additional units are purchased

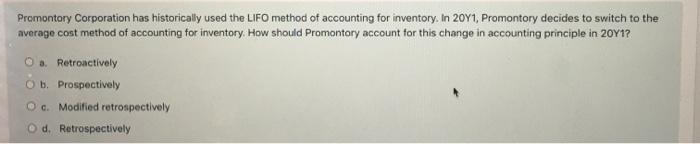

a. In a perpetual average cost system (Select all that apply): a. A new weighted-average unit cost is calculated each time additional units are purchased b. Cost of Goods Sold is generally in between where it would be if perpetual LIFO or perpetual FIFO were used (assuming rising prices) Oc. The cost allocated to ending inventory is generally higher than it would be in a perpetual FIFO inventory system (assuming rising prices) d. The cost allocated to ending inventory is generally the same as it would be in a perpetual LIFO inventory system (assuming rising prices) Promontory Corporation has historically used the LIFO method of accounting for inventory. In 2011, Promontory decides to switch to the average cost method of accounting for inventory. How should Promontory account for this change in accounting principle in 20Y1? O a Retroactively Ob. Prospectively Oc. Modified retrospectively d. Retrospectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts