Question: (a) is $8,907.95 Looking for part (b) please Consider a 7-year 5% coupon bond with a YTM of r(2) = 7% and a face value

(a) is $8,907.95

Looking for part (b) please

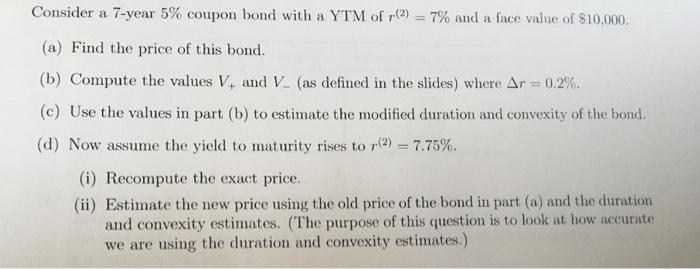

Consider a 7-year 5% coupon bond with a YTM of r(2) = 7% and a face value of $10,000. (a) Find the price of this bond. (b) Compute the values V and V. (as defined in the slides) where Ar=0.2%. (c) Use the values in part (b) to estimate the modified duration and convexity of the bond. (d) Now assume the yield to maturity rises to p(2) = 7.75%. (i) Recompute the exact price. (ii) Estimate the new price using the old price of the bond in part (a) and the duration and convexity estimates. (The purpose of this question is to look at how accurate we are using the duration and convexity estimates.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock