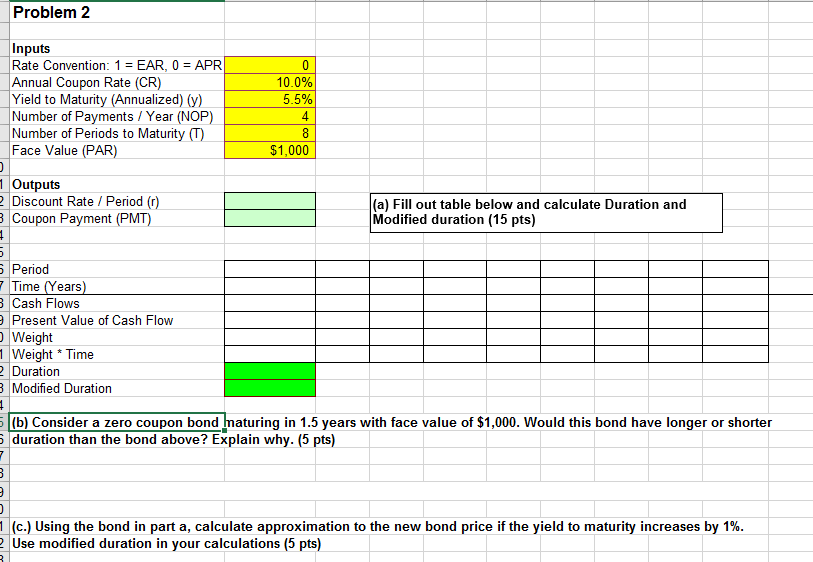

Question: Problem 2 Inputs Rate Convention: 1 = EAR, 0 = APR Annual Coupon Rate (CR) Yield to Maturity (Annualized) (y) Number of Payments / Year

Problem 2 Inputs Rate Convention: 1 = EAR, 0 = APR Annual Coupon Rate (CR) Yield to Maturity (Annualized) (y) Number of Payments / Year (NOP) Number of Periods to Maturity (T) Face Value (PAR) 0 10.0% 5.5% 4 8 $1,000 1 Outputs 2 Discount Rate / Period (r) (a) Fill out table below and calculate Duration and 3 Coupon Payment (PMT) Modified duration (15 pts) 1 5 5 Period 7 Time (Years) 3 Cash Flows Present Value of Cash Flow Weight 1 Weight * Time 2 Duration Modified Duration 1 (b) Consider a zero coupon bond naturing in 1.5 years with face value of $1,000. Would this bond have longer or shorter duration than the bond above? Explain why. (5 pts) 7 3 . 1 (c.) Using the bond in part a, calculate approximation to the new bond price if the yield to maturity increases by 1%. 2 Use modified duration in your calculations (5 pts) R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts