Question: A is a U.S.-based MNC with AAA credit: B is an Italian firm with AAA credit. Firm A wants to borrow 1,000,000 for one year

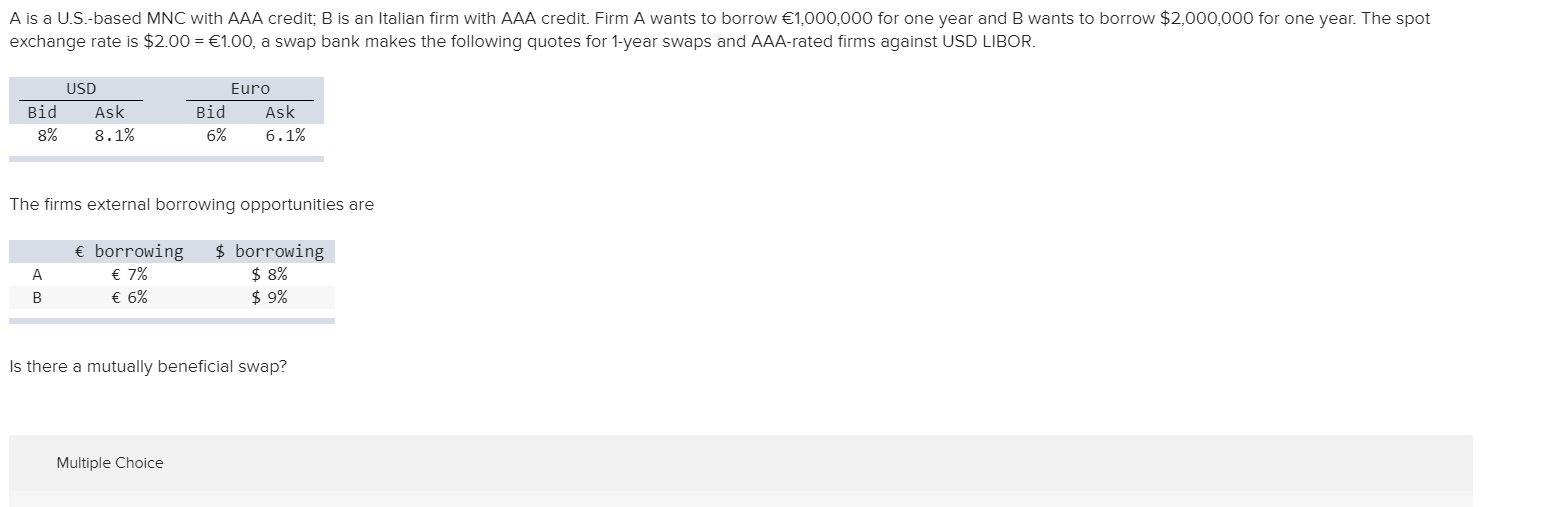

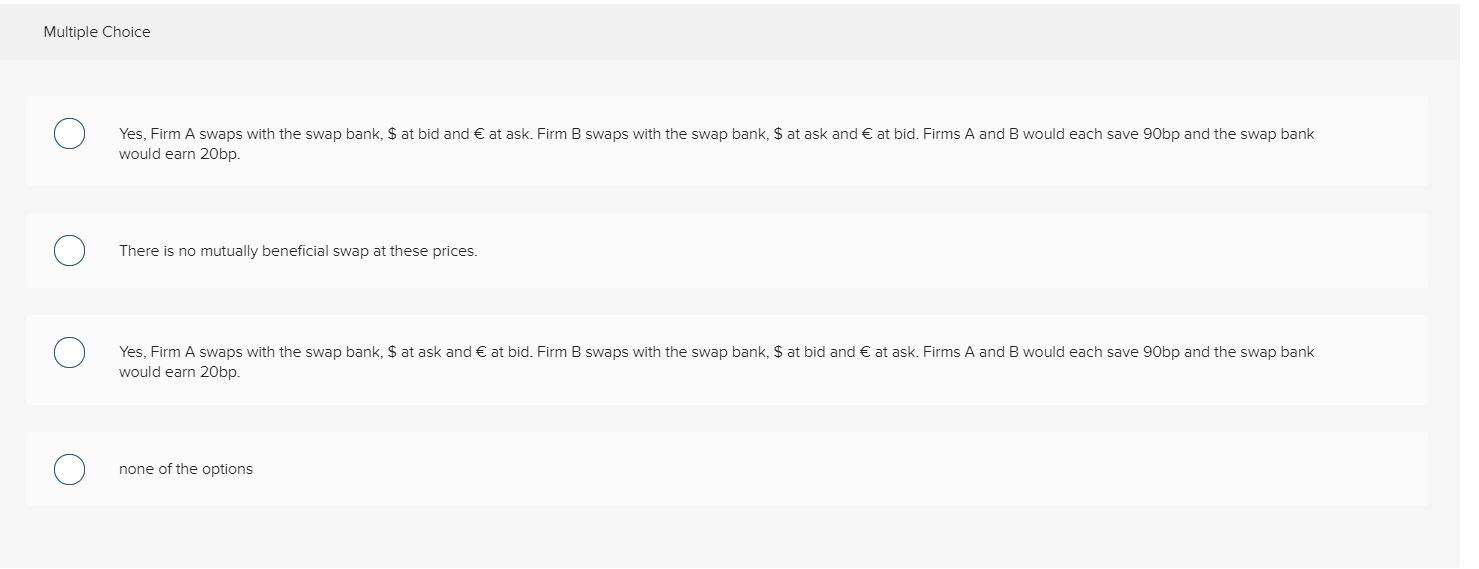

A is a U.S.-based MNC with AAA credit: B is an Italian firm with AAA credit. Firm A wants to borrow 1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = 1.00, a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR. USD Bid 8% Ask 8.1% Euro Bid Ask 6% 6.1% The firms external borrowing opportunities are A B borrowing 7% 6% $ borrowing $ 8% $ 9% Is there a mutually beneficial swap? Multiple Choice Multiple Choice Yes, Firm A swaps with the swap bank, $ at bid and at ask, Firm B swaps with the swap bank, $ at ask and at bid. Firms A and B would each save 90bp and the swap bank would earn 20bp There is no mutually beneficial swap at these prices. Yes, Firm A swaps with the swap bank, $ at ask and at bid. Firm B swaps with the swap bank, $ at bid and at ask. Firms A and B would each save 90bp and the swap bank would earn 20bp. none of the options A is a U.S.-based MNC with AAA credit: B is an Italian firm with AAA credit. Firm A wants to borrow 1,000,000 for one year and B wants to borrow $2,000,000 for one year. The spot exchange rate is $2.00 = 1.00, a swap bank makes the following quotes for 1-year swaps and AAA-rated firms against USD LIBOR. USD Bid 8% Ask 8.1% Euro Bid Ask 6% 6.1% The firms external borrowing opportunities are A B borrowing 7% 6% $ borrowing $ 8% $ 9% Is there a mutually beneficial swap? Multiple Choice Multiple Choice Yes, Firm A swaps with the swap bank, $ at bid and at ask, Firm B swaps with the swap bank, $ at ask and at bid. Firms A and B would each save 90bp and the swap bank would earn 20bp There is no mutually beneficial swap at these prices. Yes, Firm A swaps with the swap bank, $ at ask and at bid. Firm B swaps with the swap bank, $ at bid and at ask. Firms A and B would each save 90bp and the swap bank would earn 20bp. none of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts