Question: please help 3. A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow 2,000,000

please help

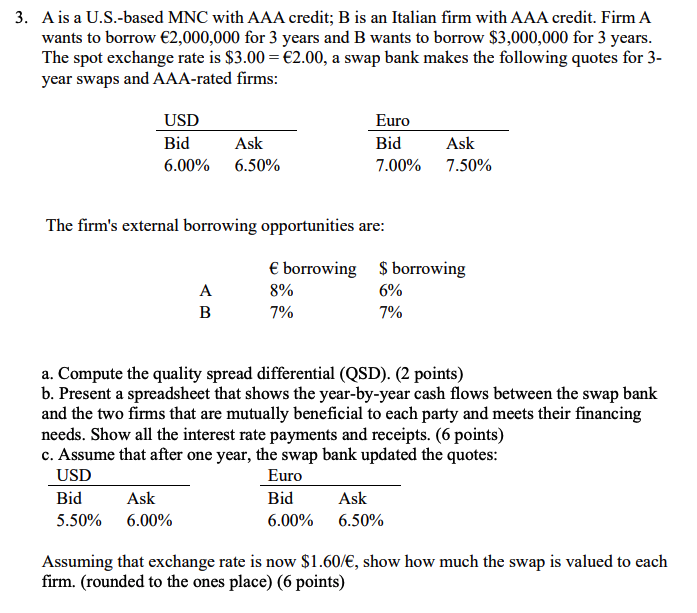

3. A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow 2,000,000 for 3 years and B wants to borrow $3,000,000 for 3 years. The spot exchange rate is $3.00 = 2.00, a swap bank makes the following quotes for 3- year swaps and AAA-rated firms: USD Bid 6.00% Ask 6.50% Euro Bid 7.00% Ask 7.50% The firm's external borrowing opportunities are: A B borrowing borrowing 8% 6% 7% 7% a. Compute the quality spread differential (QSD). (2 points) b. Present a spreadsheet that shows the year-by-year cash flows between the swap bank and the two firms that are mutually beneficial to each party and meets their financing needs. Show all the interest rate payments and receipts. (6 points) c. Assume that after one year, the swap bank updated the quotes: USD Euro Bid Ask Bid Ask 5.50% 6.00% 6.00% 6.50% Assuming that exchange rate is now $1.60/, show how much the swap is valued to each firm. (rounded to the ones place) (6 points) 3. A is a U.S.-based MNC with AAA credit; B is an Italian firm with AAA credit. Firm A wants to borrow 2,000,000 for 3 years and B wants to borrow $3,000,000 for 3 years. The spot exchange rate is $3.00 = 2.00, a swap bank makes the following quotes for 3- year swaps and AAA-rated firms: USD Bid 6.00% Ask 6.50% Euro Bid 7.00% Ask 7.50% The firm's external borrowing opportunities are: A B borrowing borrowing 8% 6% 7% 7% a. Compute the quality spread differential (QSD). (2 points) b. Present a spreadsheet that shows the year-by-year cash flows between the swap bank and the two firms that are mutually beneficial to each party and meets their financing needs. Show all the interest rate payments and receipts. (6 points) c. Assume that after one year, the swap bank updated the quotes: USD Euro Bid Ask Bid Ask 5.50% 6.00% 6.00% 6.50% Assuming that exchange rate is now $1.60/, show how much the swap is valued to each firm. (rounded to the ones place) (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts