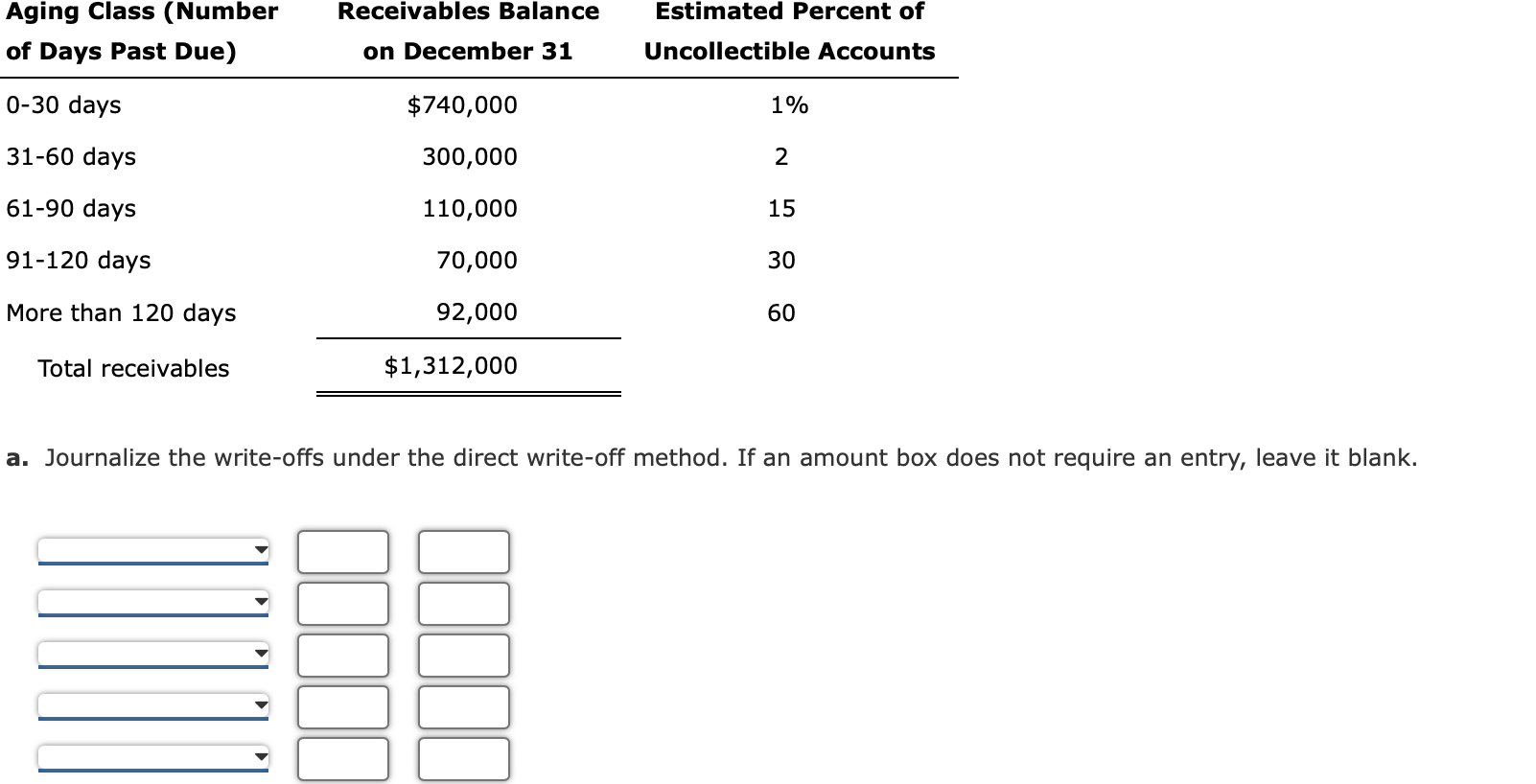

Question: a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. o. Journalize the write-offs

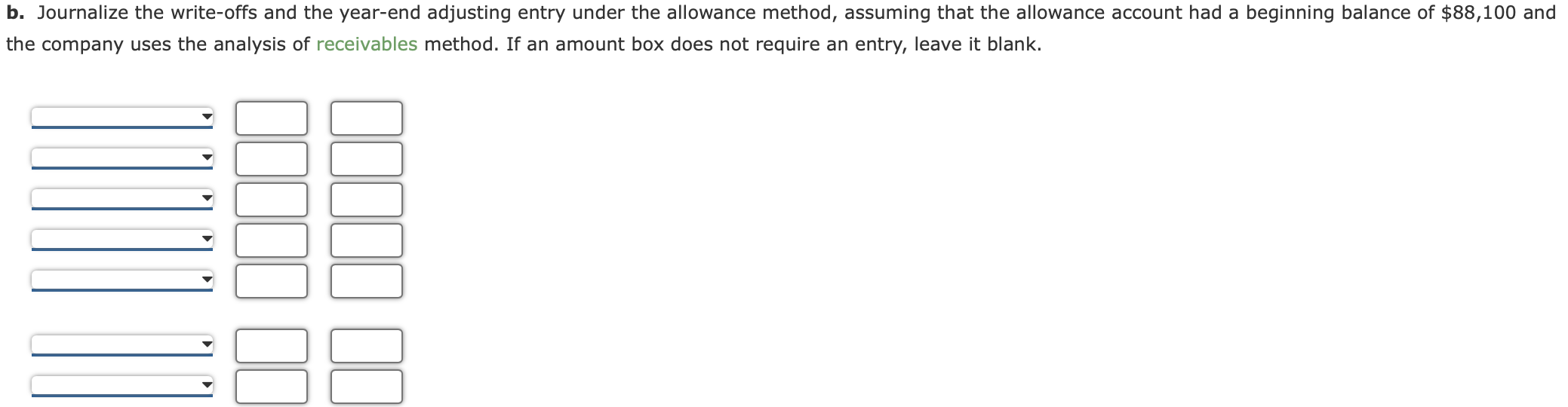

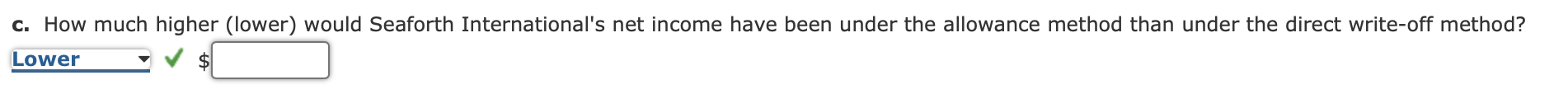

a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. o. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $88,100 and ihe company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank. c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? $ a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. o. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $88,100 and ihe company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank. c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts