Question: a) KI just announced that it will cut its dividend from 3.00 to 2.50 per share and use the extra funds to expand its

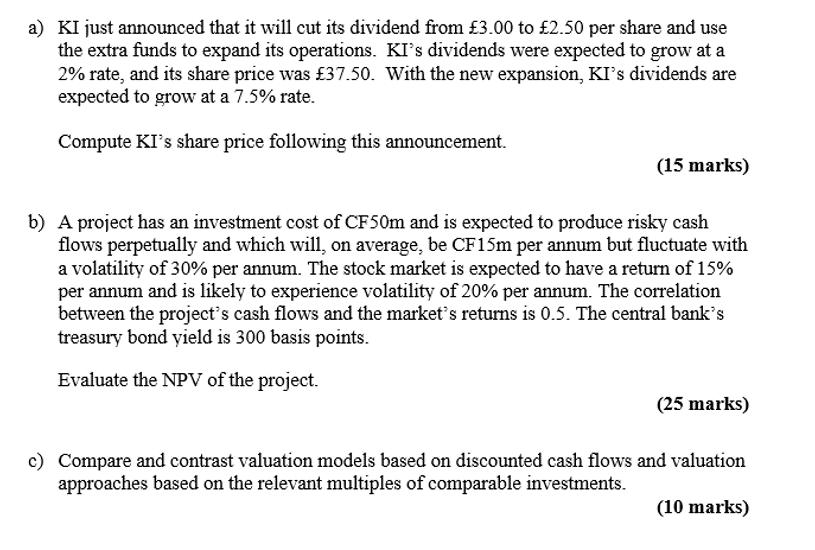

a) KI just announced that it will cut its dividend from 3.00 to 2.50 per share and use the extra funds to expand its operations. KI's dividends were expected to grow at a 2% rate, and its share price was 37.50. With the new expansion, KI's dividends are expected to grow at a 7.5% rate. Compute KI's share price following this announcement. (15 marks) b) A project has an investment cost of CF50m and is expected to produce risky cash flows perpetually and which will, on average, be CF15m per annum but fluctuate with a volatility of 30% per annum. The stock market is expected to have a return of 15% per annum and is likely to experience volatility of 20% per annum. The correlation between the project's cash flows and the market's returns is 0.5. The central bank's treasury bond yield is 300 basis points. Evaluate the NPV of the project. (25 marks) c) Compare and contrast valuation models based on discounted cash flows and valuation approaches based on the relevant multiples of comparable investments. (10 marks)

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

KI dividends Student Name Institutional affiliation Course Professors Name Date KI dividends KI announced that it will cut dividends from 30 to 25 per share and use extra funds to fund its businessKI ... View full answer

Get step-by-step solutions from verified subject matter experts