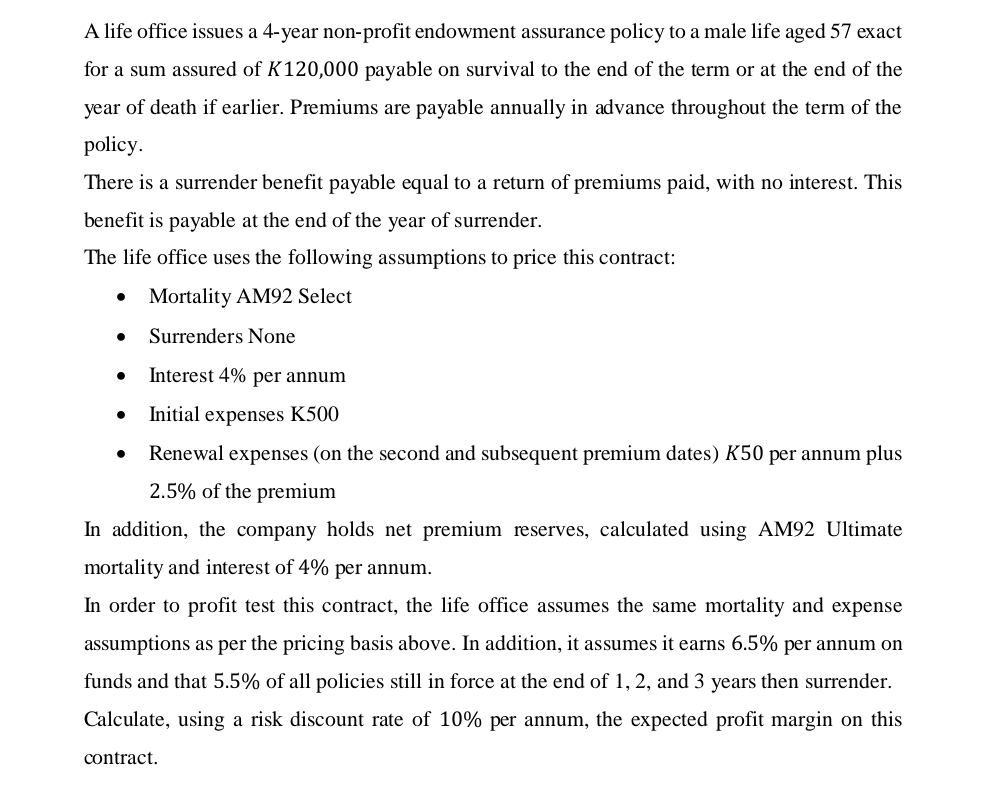

Question: A life office issues a 4 - year non - profit endowment assurance policy to a male life aged 5 7 exact for a sum

A life office issues a year nonprofit endowment assurance policy to a male life aged exact

for a sum assured of payable on survival to the end of the term or at the end of the

year of death if earlier. Premiums are payable annually in advance throughout the term of the

policy.

There is a surrender benefit payable equal to a return of premiums paid, with no interest. This

benefit is payable at the end of the year of surrender.

The life office uses the following assumptions to price this contract:

Mortality AM Select

Surrenders None

Interest per annum

Initial expenses K

Renewal expenses on the second and subsequent premium dates per annum plus

of the premium

In addition, the company holds net premium reserves, calculated using AM Ultimate

mortality and interest of per annum.

In order to profit test this contract, the life office assumes the same mortality and expense

assumptions as per the pricing basis above. In addition, it assumes it earns per annum on

funds and that of all policies still in force at the end of and years then surrender.

Calculate, using a risk discount rate of per annum, the expected profit margin on this

contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock